Knowledge reveals that the Bitcoin Open Curiosity has hit a brand new all-time excessive (ATH) as the value of the cryptocurrency has risen above $72,000.

Bitcoin Open Curiosity has soared these days

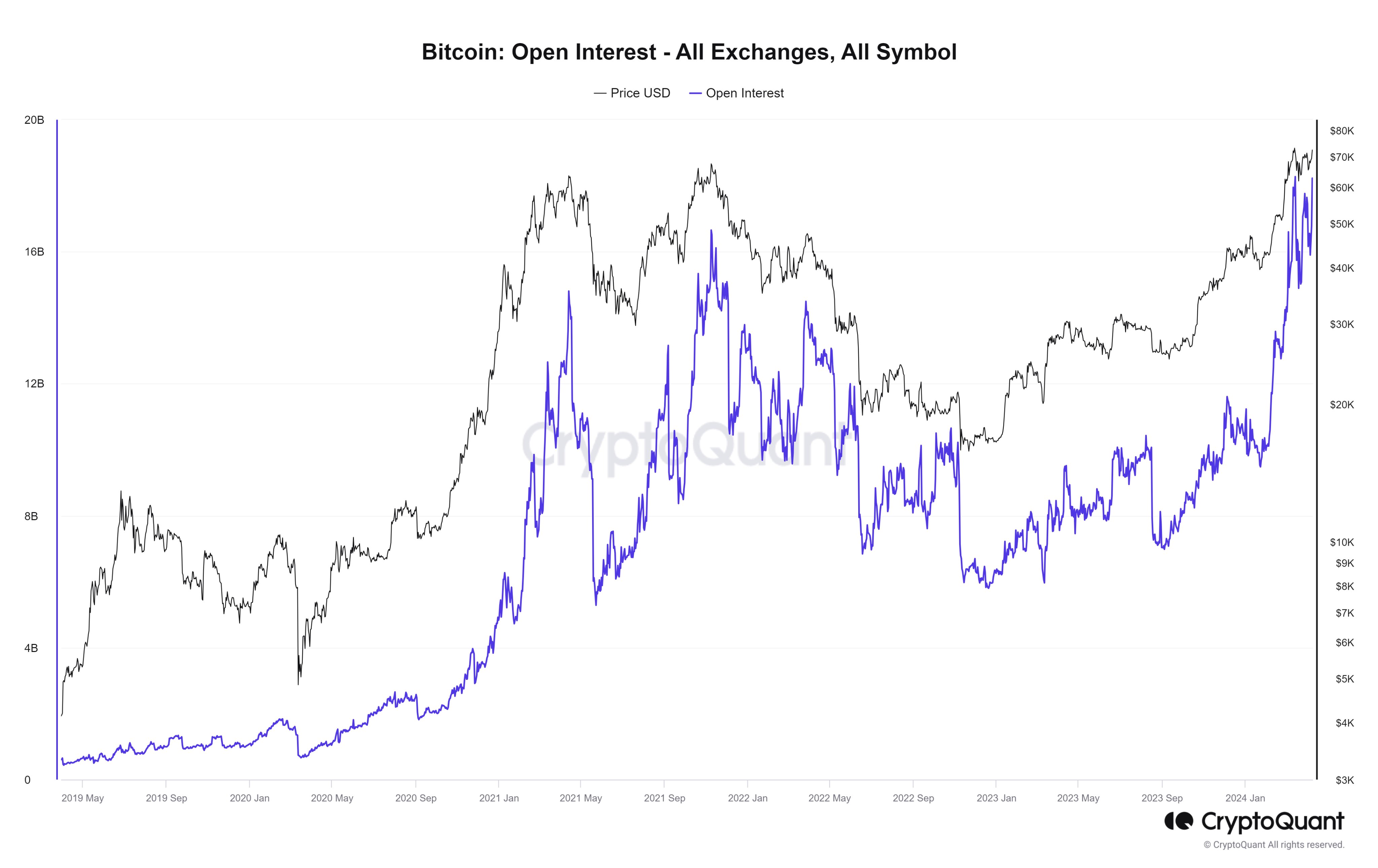

CryptoQuant Netherlands neighborhood supervisor Maarunn explains it in a after on X that the BTC Open Curiosity has simply reached a brand new ATH. The “Open Curiosity” is an indicator that tracks the full variety of Bitcoin spinoff contracts at the moment open on all exchanges.

When the worth of this measure will increase, traders will open extra positions within the derivatives market right now. Basically, the full leverage out there will increase when this development happens. As such, the asset is extra prone to turn out to be risky following an increase in Open Curiosity.

However, the bearish indicator implies that traders are both closing their positions on their very own accord or being forcibly liquidated by the platform on which their place is open. Since leverage would lower on this state of affairs, the value might turn out to be extra secure.

Here’s a chart displaying the development in Bitcoin Open Curiosity over the previous few years:

The worth of the metric appears to have been going up in latest days | Supply: CryptoQuant

As proven within the chart above, the Bitcoin Open Curiosity has lately registered sharp progress, rising to a brand new ATH of roughly $18.2 billion. This enhance is as a result of the value of the cryptocurrency has additionally elevated.

This development is nothing uncommon, as value jumps normally draw loads of consideration to the cryptocurrency, bringing with it a brand new spherical of hypothesis on the derivatives facet.

The indicator’s earlier ATH was reached final month when Bitcoin set a value report above the $73,000 degree. Nonetheless, as talked about earlier, the rising indicator can result in extra volatility within the value.

In principle, this volatility can go both manner, however latest spikes within the metric have coincided with native value spikes. The chart reveals that the earlier Open Curiosity ATH additionally expired in a speedy decline within the asset.

It’s tough to say whether or not BTC will observe an identical destiny this time, however what may be stated is that it might possible turn out to be extra risky sooner or later if these excessive Open Curiosity ranges proceed.

As talked about, the earlier Open Curiosity ATH led to a pointy downturn for Bitcoin. Naturally, throughout such value fluctuations, numerous liquidations happen.

Nonetheless, such liquidations solely additional feed into the value motion that brought on it, thus prolonging it. This then results in much more liquidations, and the cycle continues.

This cascade of liquidations is called a ‘squeeze’. The most recent value rally has additionally led to large quantities of liquidations, as quick positions within the cryptocurrency sector took a $108 million hit.

The liquidation knowledge within the cryptocurrency sector for the previous 24 hours | Supply: CoinGlass

BTC value

On the time of writing, Bitcoin is buying and selling round $71,500, up 5% from the previous week.

Appears like the value of the coin has been rising lately | Supply: BTCUSD on TradingView

Featured picture by André François McKenzie on Unplash.com, CoinGlass.com, CryptoQuant.com, chart from TradingView.com