Knowledge from the chain exhibits that inflows to Bitcoin exchanges have remained low recently, an indication that the whales should not inquisitive about promoting.

Bitcoin inflows for Binance and OKX have remained low recently

As famous by CryptoQuant founder and CEO Ki Younger Ju in a after on X, BTC deposits for cryptocurrency exchanges Binance and OKX have been low recently.

The on-chain indicator of curiosity right here is the ‘trade influx’, which tracks the full quantity of Bitcoin transferred to the wallets related to centralized exchanges.

When the worth of this metric is excessive, it signifies that the traders are at present depositing a lot of tokens on these platforms. Since one of many foremost causes holders would swap to the exchanges is for promoting functions, these kinds of traits can have bearish implications for the asset.

However, the low indicator signifies that these platforms should not at present seeing as many deposits. Relying on the pattern within the reverse measure, the inventory market outflow, such a studying might be bullish or impartial for the cryptocurrency’s worth.

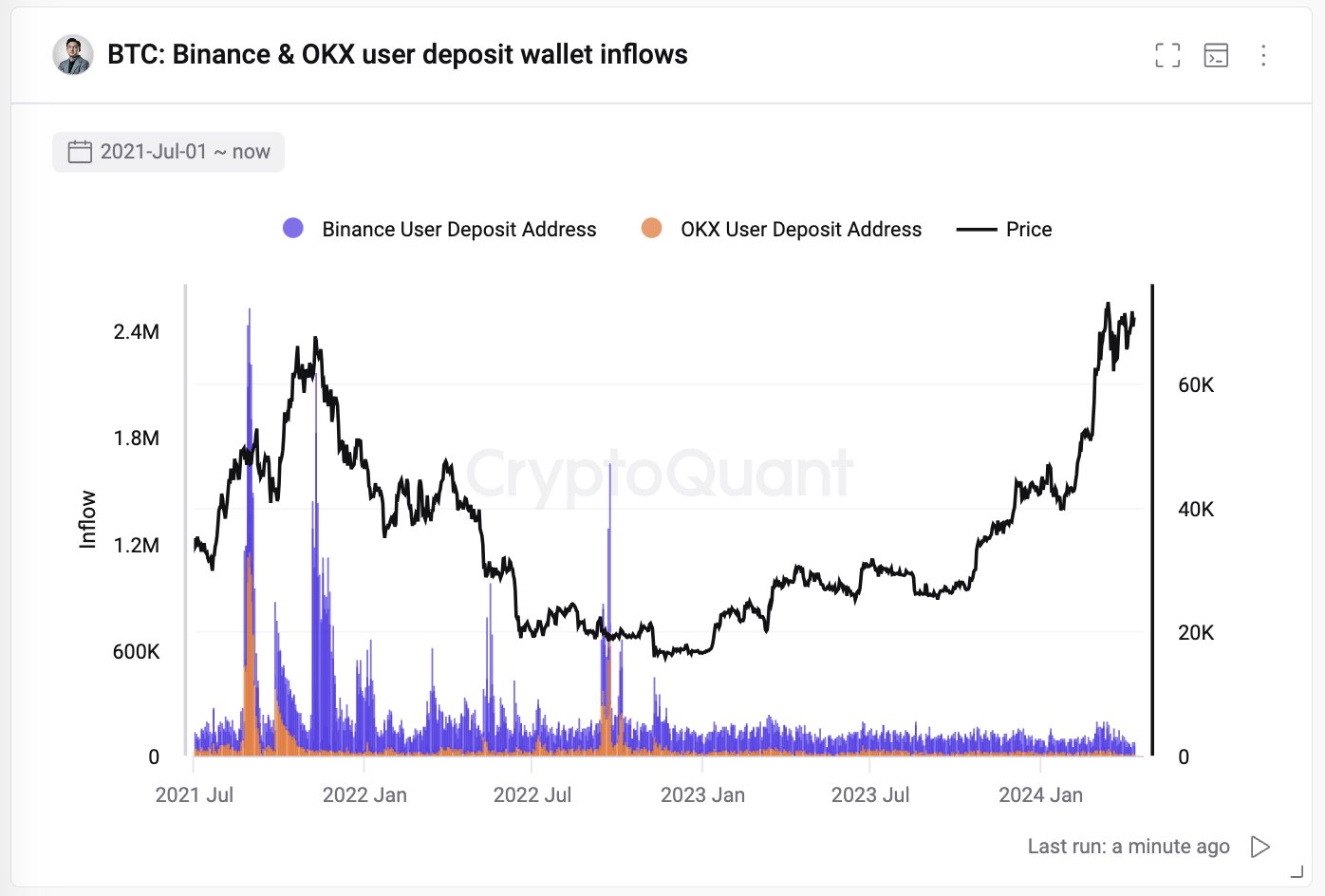

Here’s a chart exhibiting the pattern in Bitcoin trade inflows for Binance and OKX over the previous few years:

The worth of the metric seems to have been low in current days | Supply: @ki_young_ju on X

Binance is the biggest trade on this planet by buying and selling quantity, whereas OKX is mostly quantity two behind it in the identical metric. Whereas these two platforms actually do not make up for the complete cryptocurrency market, person habits on them would nonetheless present an estimate of the broader sample.

As seen within the chart, foreign money inflows for Binance and OKX have been at comparatively low ranges for a while. When BTC noticed its rally in direction of a brand new all-time excessive (ATH) earlier this 12 months, deposits noticed a slight upward pattern, however not too long ago inflows dropped again to low values.

This might point out that the demand for gross sales, particularly from the whales, merely hasn’t been there for the cryptocurrency. Even the ATH pause might solely entice a number of main customers of the platforms to promote.

The habits is in distinction to, for instance, the second half of the 2021 bull run, as proven within the chart. Not solely had the rally again then seen some distinctive spikes in inflows, however base inflows had additionally usually been larger than current ranges.

Curiously, the 2 foremost tops of the rally additionally coincided fairly effectively with extraordinarily massive inflows, so if we observe this sample, the present rally is probably not near a high but.

Nonetheless, it stays to be seen whether or not this similar pattern will proceed on this cycle given the brand new emergence of spot exchange-traded funds (ETFs).

The ETFs have supplied another technique of gaining publicity to the asset, which means cryptocurrency exchanges might not have the identical relevance available in the market.

BTC worth

On the time of writing, Bitcoin is hovering round $70,400, up greater than 5% prior to now seven days.

Appears like the value of the coin has principally moved sideways not too long ago | Supply: BTCUSD on TradingView

Featured picture by Thomas Lipke on Unsplash.com, CryptoQuant.com, chart from TradingView.com