share this text

![]()

![]()

The worth of Bitcoin (BTC) has proven volatility forward of tomorrow’s US Client Worth Index (CPI) report. In response to CoinGecko information, after surging previous $72,000 earlier this week, Bitcoin fell beneath $68,500 on Tuesday. BTC is buying and selling round $68,800 on the time of writing, down 4% within the final 24 hours.

The CPI report, due out Wednesday, is anticipated to have a big influence on Federal Reserve coverage, particularly concerning rates of interest. Final month’s CPI inflation was reported at 3.2%, whereas the core CPI was 3.8%. Projections for the upcoming information estimate a CPI of three.4% and a core CPI of three.7%.

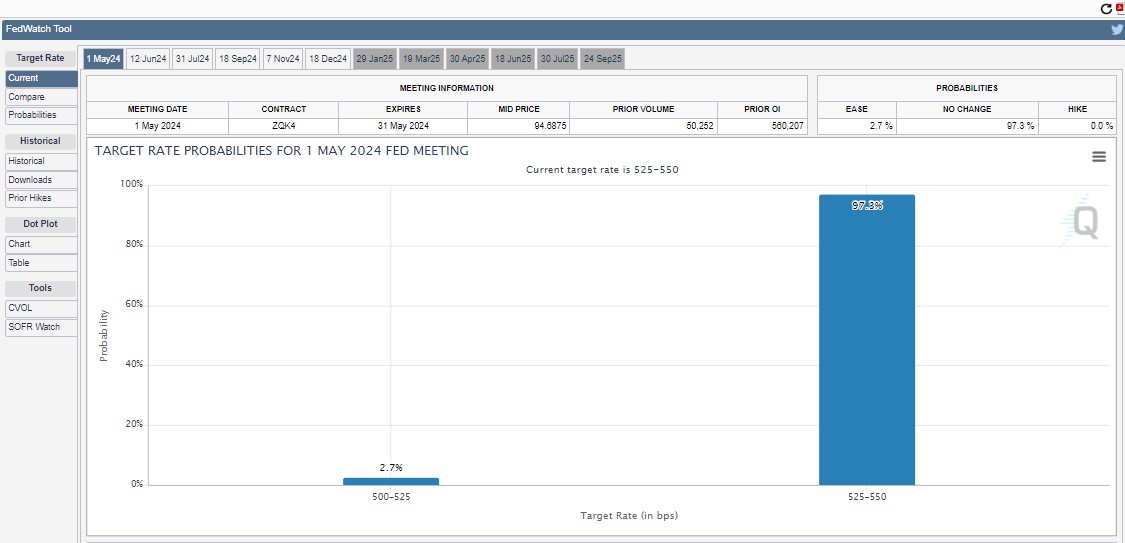

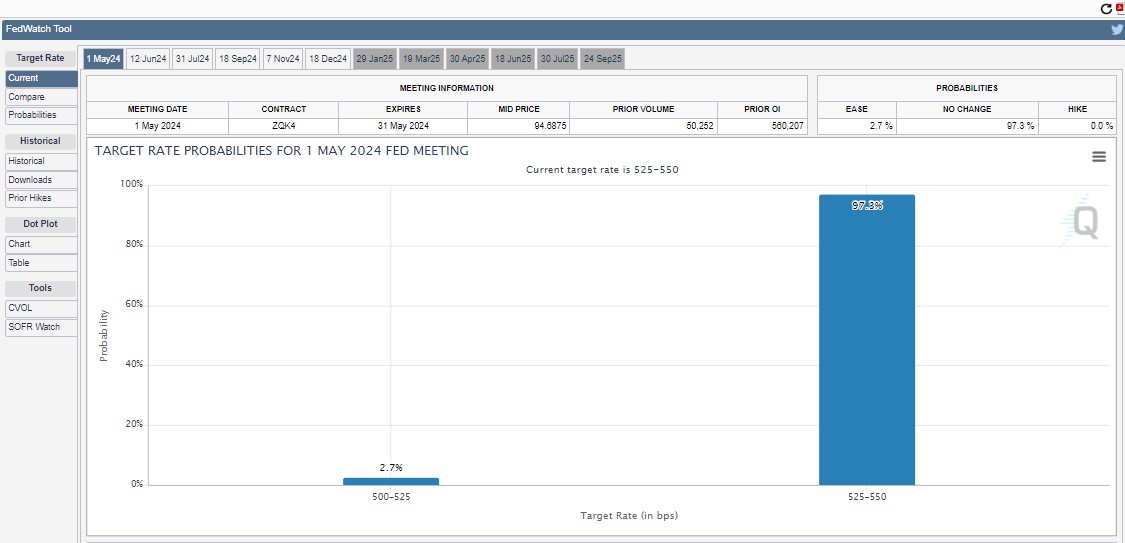

Estimates the CME FedWatch Software exhibits that the Fed will hold charges at a 97.3% vary of 525-550 foundation factors on the subsequent FOMC assembly in Could, with solely a 2.7% likelihood of a fee lower.

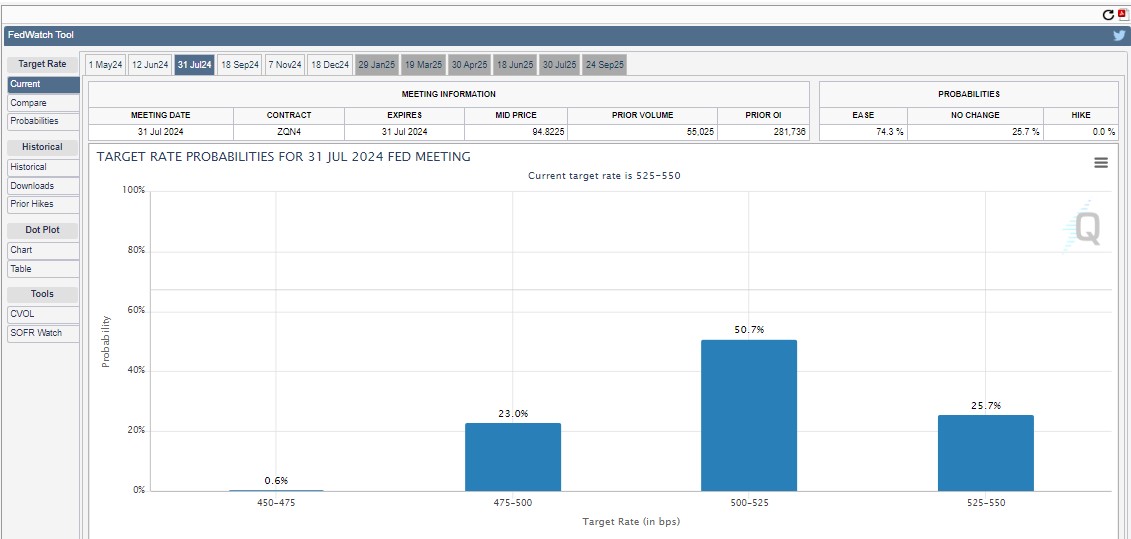

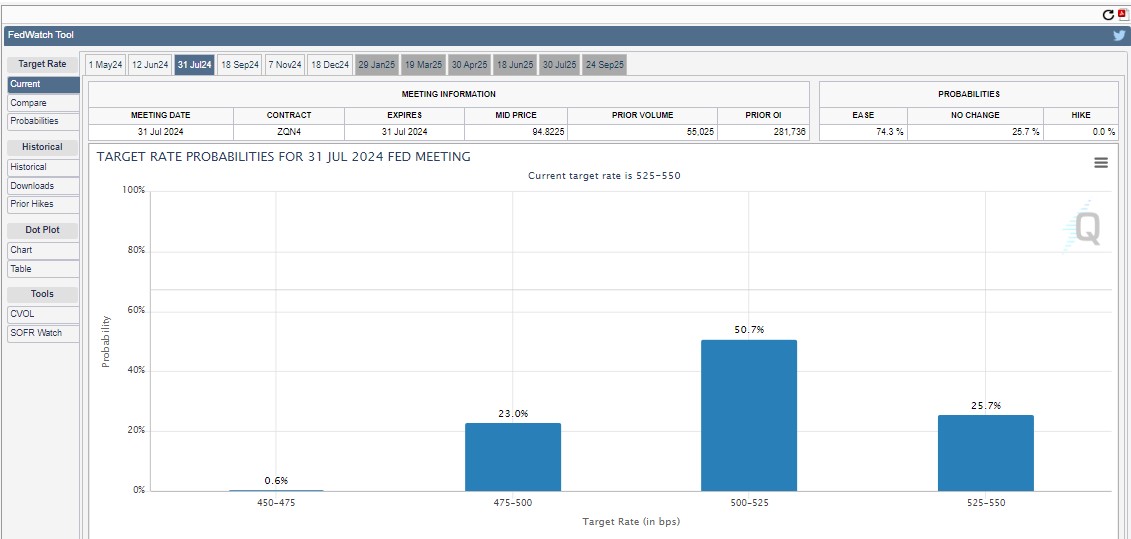

Regardless of the present uncertainty, the market is bearing in mind a excessive likelihood of rate of interest cuts from July.

Economists polled by Reuters anticipate the headline CPI to rise 3.4% year-on-year, marking a slight decline in inflation and transferring nearer to the Fed’s goal.

Final week, Fed Chairman Jerome Powell pressured that the Fed wants extra proof that inflation is slowing earlier than reducing charges. Different Fed officers additionally signaled a choice for a extra cautious and tighter stance in easing financial coverage.

Bitcoin’s faltering momentum is roiling the crypto market, sending most altcoins into correction mode. Ethereum (ETH), after rising 8% on Monday, has misplaced these positive factors and is now down 4.5% over the previous 24 hours, based on CoinGecko information.

Nonetheless, not all cash observe swimsuit. The Open Community (TON) and Fantom (FTM) bucked the development and rose 8% every at this time.

share this text

![]()

![]()