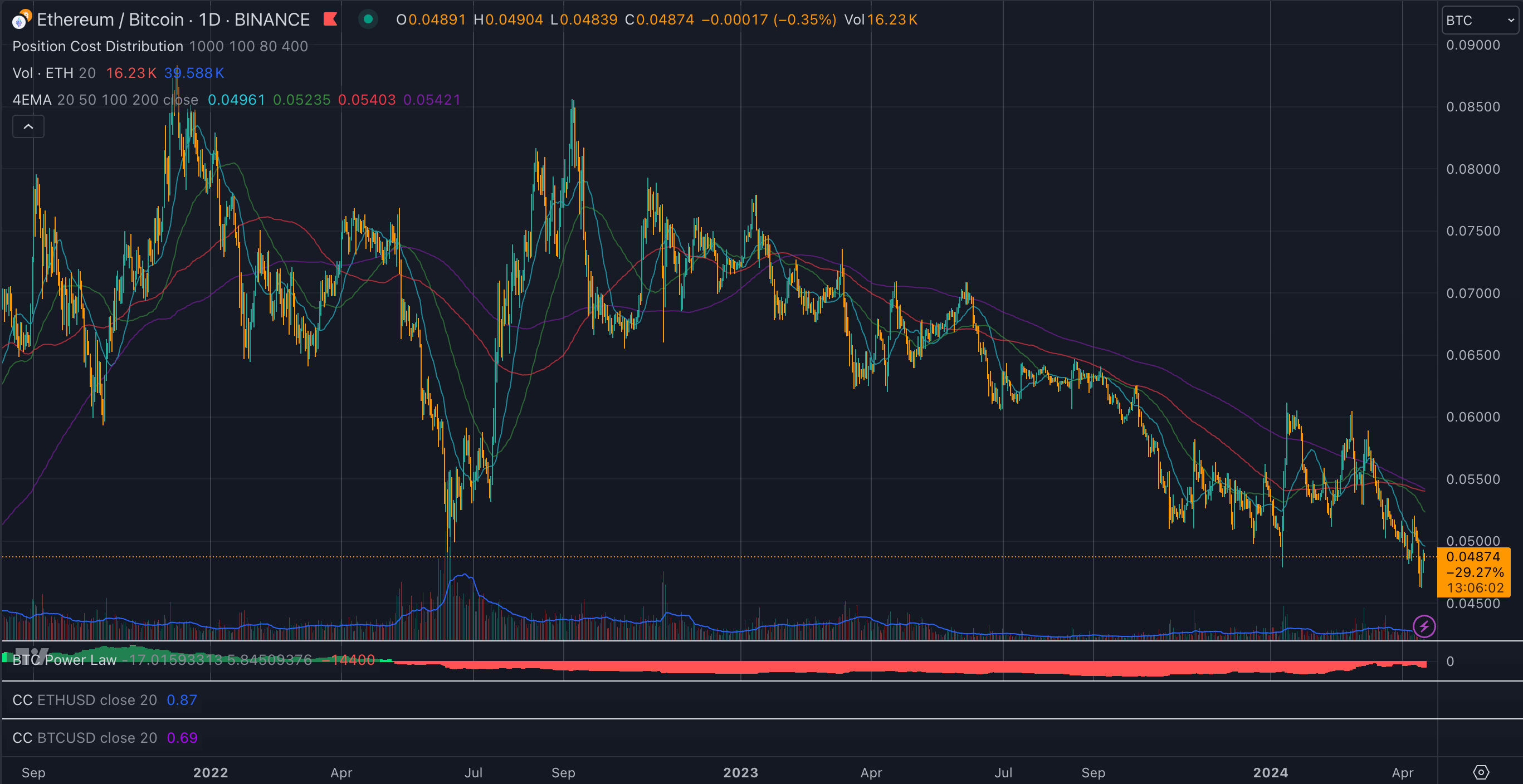

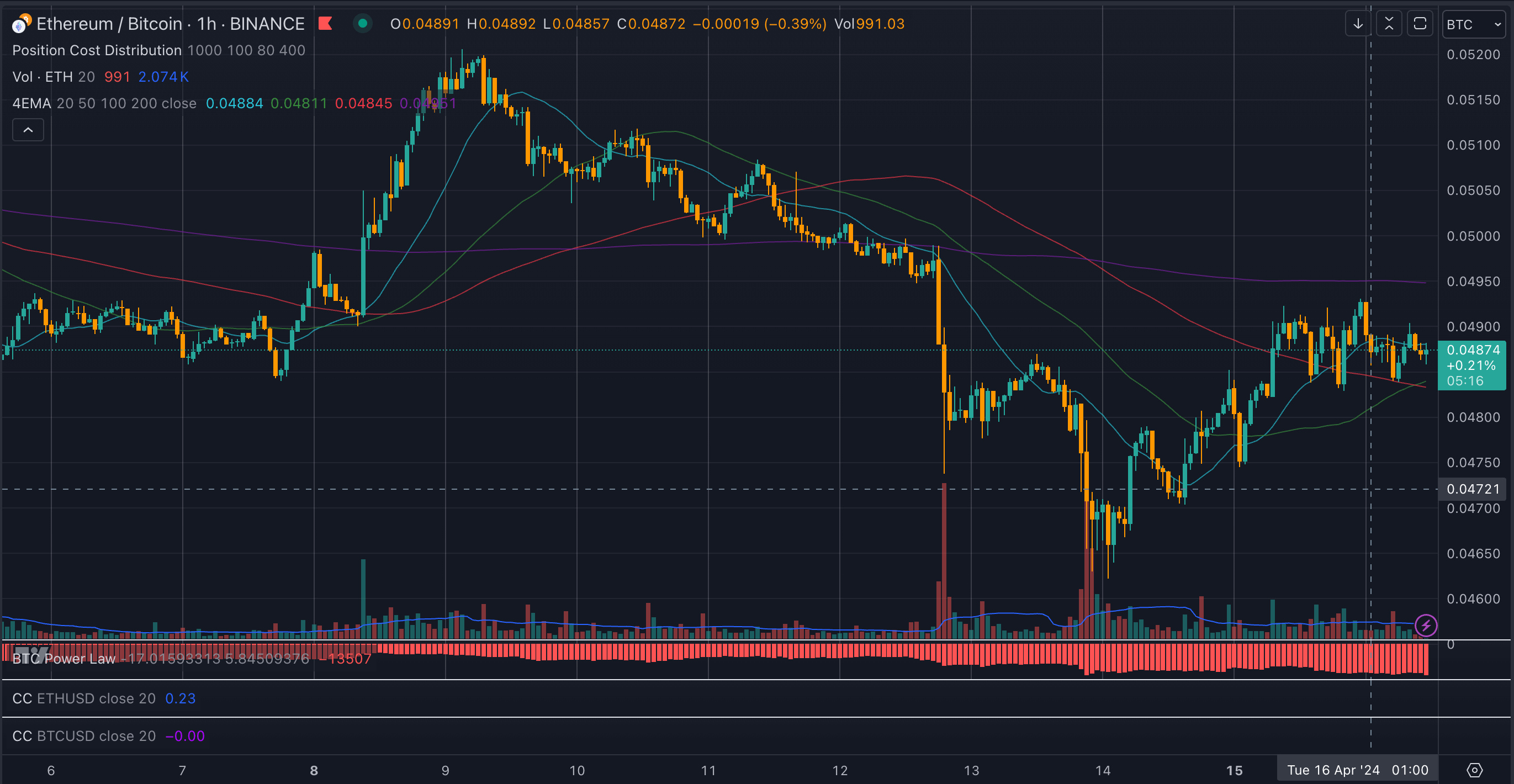

Ethereum fell to a three-year low in opposition to Bitcoin amid the carnage that adopted Bitcoin’s fall from $70,000 this weekend. The ETH-BTC chart hit a low of 0.0462 BTC on Saturday, April 13, down 24% from the year-to-date excessive of 0.085 BTC.

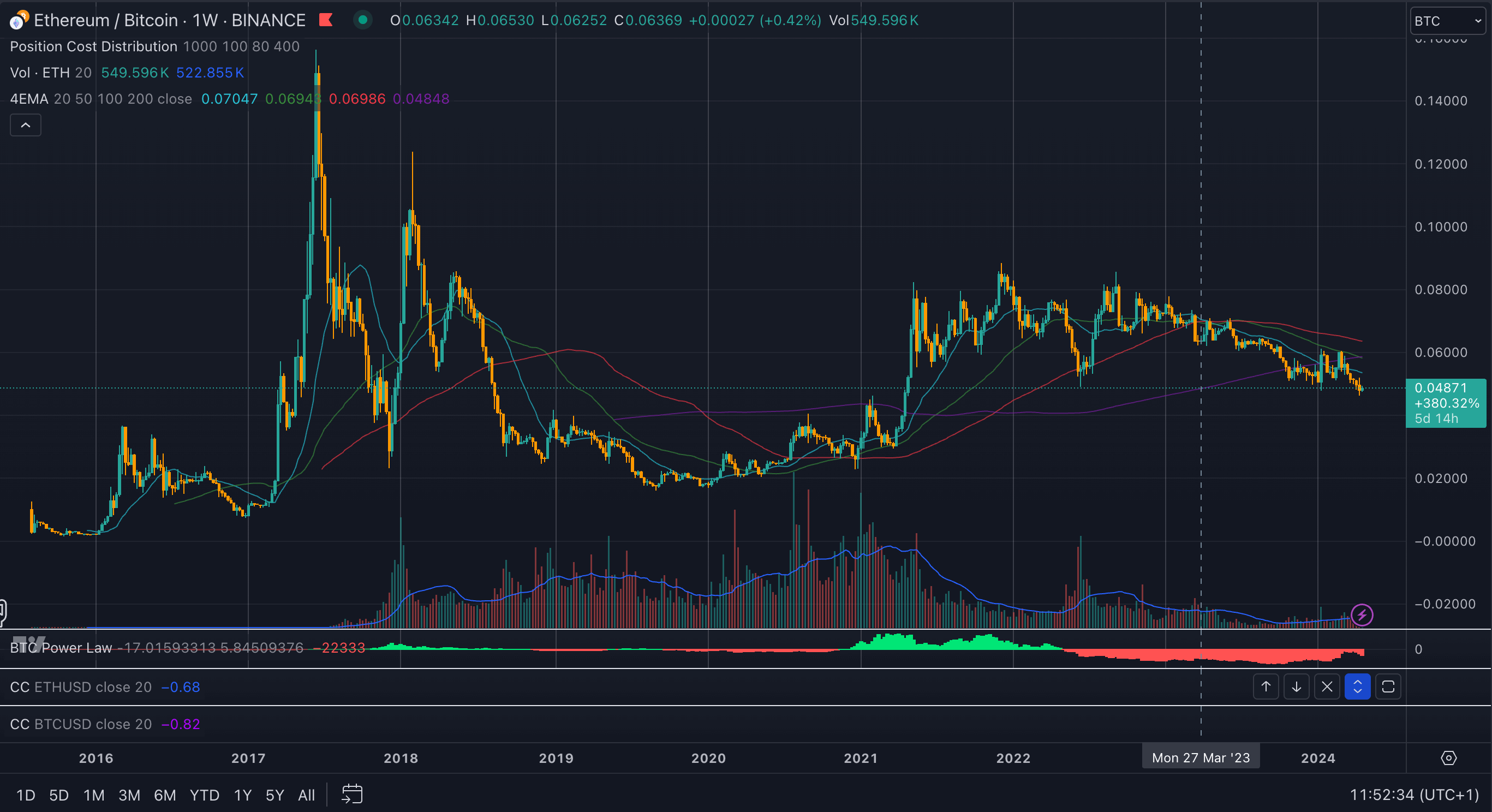

Ethereum’s all-time excessive in opposition to Bitcoin got here in 2017 when it reached 0.16 BTC, earlier than closing the yr at an analogous stage to in the present day at 0.048 BTC. Since then, it has recorded lows round 0.018 BTC in late 2019 earlier than rising considerably throughout the 2020-2021 bull market.

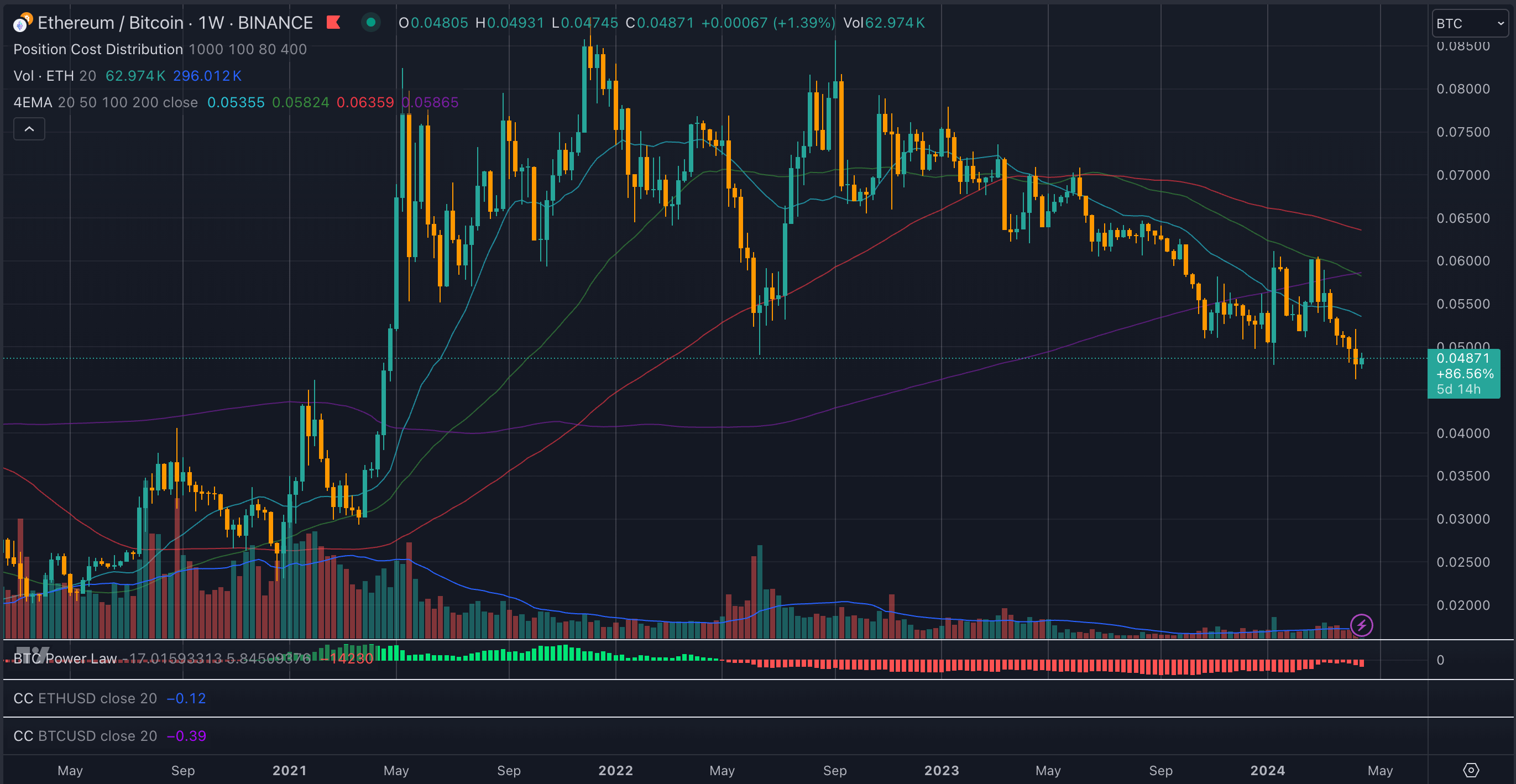

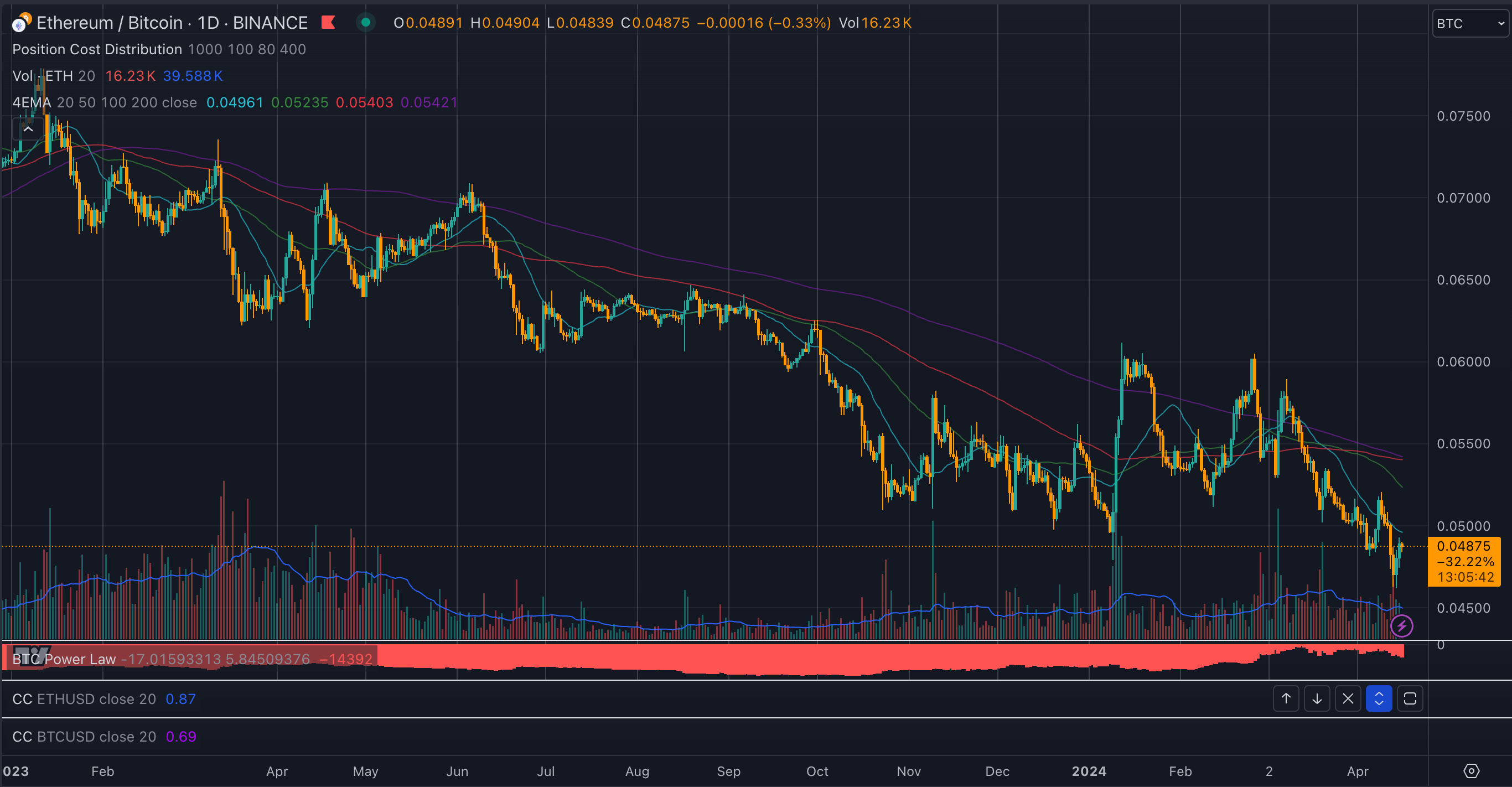

The cycle peak of 0.088 BTC noticed a gradual decline in 2023, 2022, and 2024. The 0.05 BTC stage acted as a decrease help stage till it was breached this month. Whereas the value stays inside 7% of help, it has been virtually three years since now we have seen these costs.

The decline has been gradual and regular since early 2023, with some bullish breakouts halted inside just a few months.

Though Ethereum stays under the 0.05 BTC help stage, it has recovered virtually 7% from its weekend low, remaining comparatively steady amid Bitcoin’s continued troubles. Bitcoin fell from $70,000 to $61,700 over the weekend earlier than recovering to $66,000. Nevertheless, Bitcoin has retested $61,700 and is buying and selling round $62,000 on the time of writing. Ethereum initially adopted Bitcoin from $3,600 to $2,800 – since then it has consolidated round $3,000, which has helped it in its worth battle with Bitcoin.

Whereas the general crypto market typically follows Bitcoin, a lot of the altcoin market follows Ethereum. The ETH-BTC chart has an ideal affect on the fragile relationship between worth actions of digital belongings, and is without doubt one of the fundamental components of the sector. Bitcoin dominance, one other vital issue, hit a three-year excessive this weekend, reaching 57%, whereas Ethereum dominance fell from a current excessive of 19% to simply 15%.

The submit Ethereum Falls to Three-12 months Low In opposition to Bitcoin Amid Panic Promoting first appeared on CryptoSlate.