- Optimism brings his cavalry

- Ethereum and L2s

Ethereum has at all times been a pioneer in a number of points of the crypto area, starting from DeFi to NFTs, in addition to excessive fuel charges and improvements to unravel its scalability points. Because the scope of the chain grew, so did the limitation of scalability.

The next article explores how layer 2 options are evolving in at present’s bear market.

Optimism brings his cavalry

Also referred to as L2 options, these are basically chains constructed to scale back the load on a blockchain’s mainnet by processing transactions and different operations off-chain and in the end connecting them again to the mainnet for finality.

For Ethereum specifically, these L2 are utilized in scaling the DeFi purposes by processing their transactions outdoors the Ethereum mainnet, whereas nonetheless sustaining the safety and decentralization requirements adopted on the mainnet.

Nonetheless, as Ethereum utilization and demand develop, these L2 methods should develop as properly. They do that primarily based on the newest developments in two of the perfect L2 options.

Optimism, an optimism rollup-based L2, not too long ago broadcast its token OP to customers, however the response was not as anticipated. With a TVL of $908 million, Optimism’s OP was anticipated to launch widespread hype.

If it wasn’t already clear, this is not your common token launch.

The Optimism Collective is a lot extra: a grand experiment in decentralized governance that can evolve over time. OP and the Token Home are simply step one.

OP drop #1 ???? is stay NOW. However first a abstract:

— Optimism (✨????_????✨) (@optimismPBC) May 31, 2022

Nonetheless, because of technical points through the launch, some customers had been in a position to declare their tokens earlier than the official airdrop started.

This resulted in customers dumping their OP tokens, and in consequence, the buying and selling worth of the token dropped from $4.5 at launch to $1.38 on the time of scripting this report.

This represents a worth drop of virtually 70% inside 72 hours of launch.

Optimism tweeted in justification of the failed launch:

“We considerably underestimated the quantity of anticipated burden this is able to have on our public RPC endpoint. When web site guests discovered the declare hyperlink, the general public RPC started to be criticized.”

They additional added that whereas they rapidly expanded obtainable sources to serve their public RPC, the method required hours of coordination because of the quantity of pressure they noticed.

Nonetheless, the value drop has presently subsided as OP isn’t being dumped excessively.

The second L2 to see growth modifications was the Boba Community, an L2 with greater than $81 million tied up.

The evolving L2 introduced its intention to turn out to be multi-chain by going past Ethereum.

IBy integrating with Fantom and Moonbeam, a parachain from Polkadot, Boba Community has gained entry to different EVM-compatible chains for the primary time.

This marks an necessary milestone for Layer 2 options. As Boba expands to different chains, it is going to present scalability for DeFi purposes on these chains by providing builders entry to Hybrid Compute.

This instrument permits Dapps to speak with cloud environments for information that isn’t obtainable within the chain.

Nonetheless, this additionally will increase competitors for Ethereum, because the chains that L2 is increasing to are centered on larger transaction speeds and decrease fuel charges, which shall be an enormous drawback for Ethereum proper now.

Ethereum and L2s

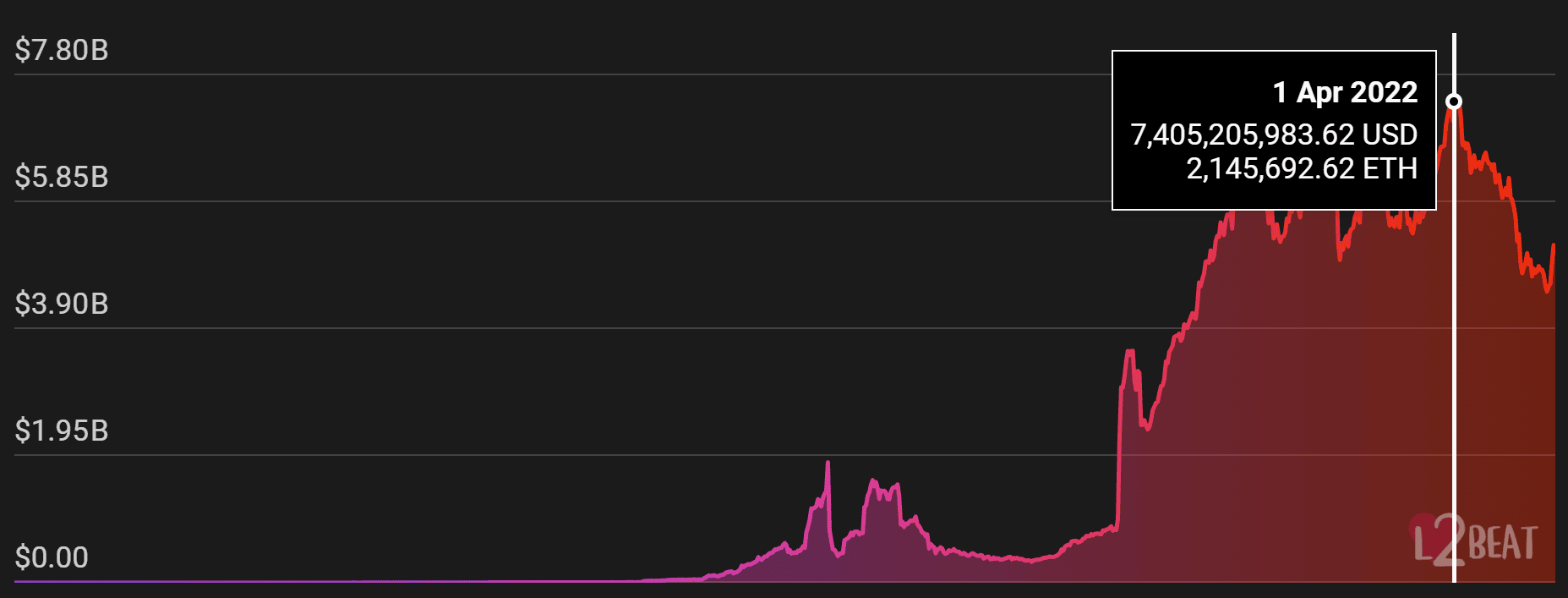

Regardless of having been round since 2019, L2 solely gained momentum final yr, in February 2021, and has grown tenfold since then.

At their peak in April 2022, L2 accounted for over $7.2 billion in investments, however after the Might 9 crash, their whole worth dropped to $5.04 billion.

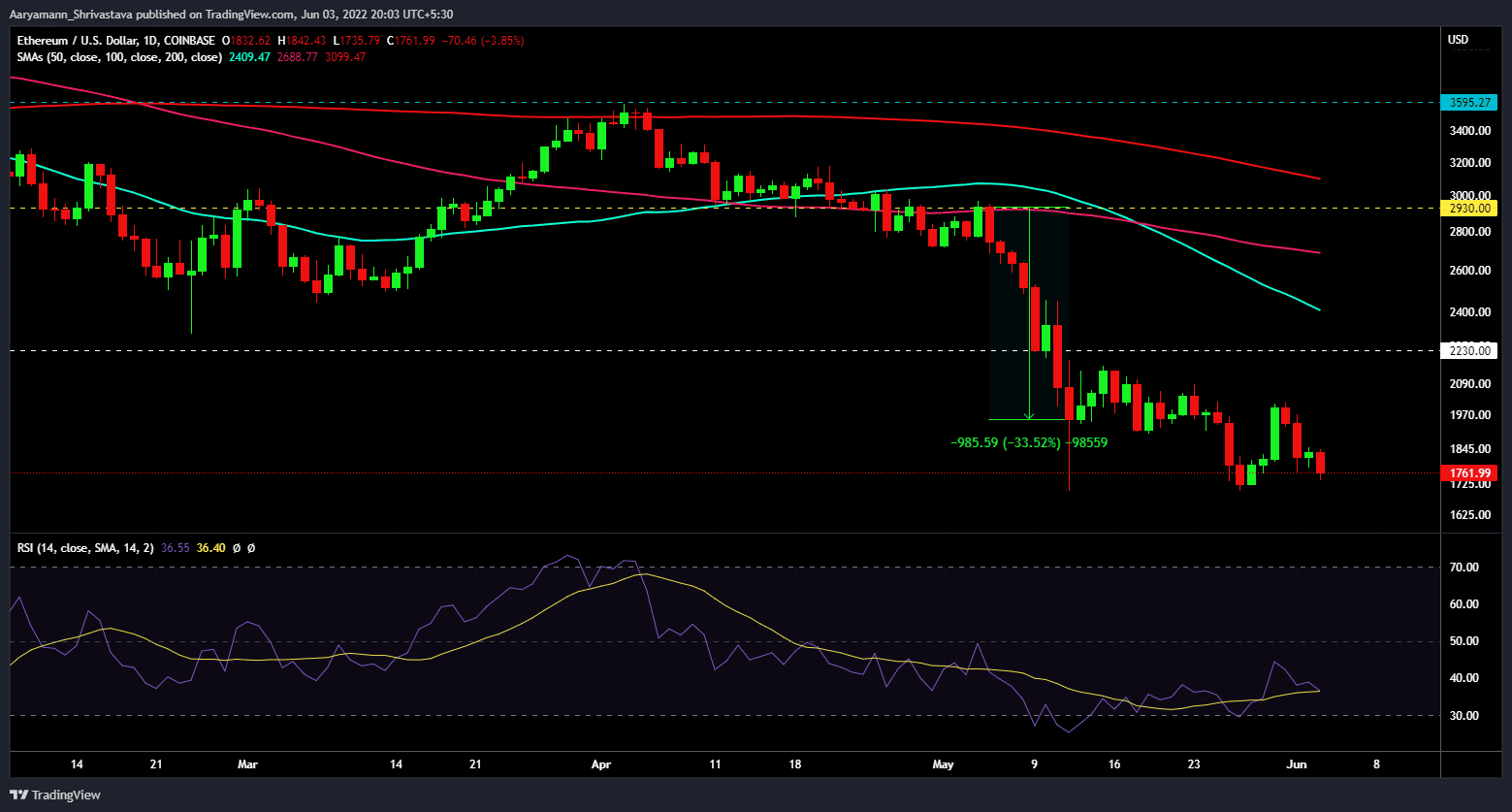

Ethereum additionally suffered a serious worth drop throughout the identical interval, and the altcoin king plummeted 33.52% and is presently buying and selling at $1760.

Moreover, as bearish stress from the broader market continues, the cryptocurrency is struggling to tug itself out of the bearish zone.

In conclusion, the restoration of Layer-2 options depends on Ethereum’s restoration into the bullish zone, which might result in an increase in TVL, bringing investments again into the chain.