The Grayscale Bitcoin Belief (GBTC), an exchange-traded fund, has skilled a major decline in outflows, reaching a document low that’s nearly 90% decrease than the day earlier than.

The newest shift occurred concurrently with Bitcoin’s value rebound after the most recent inflation information was launched in the USA, injecting volatility into the market.

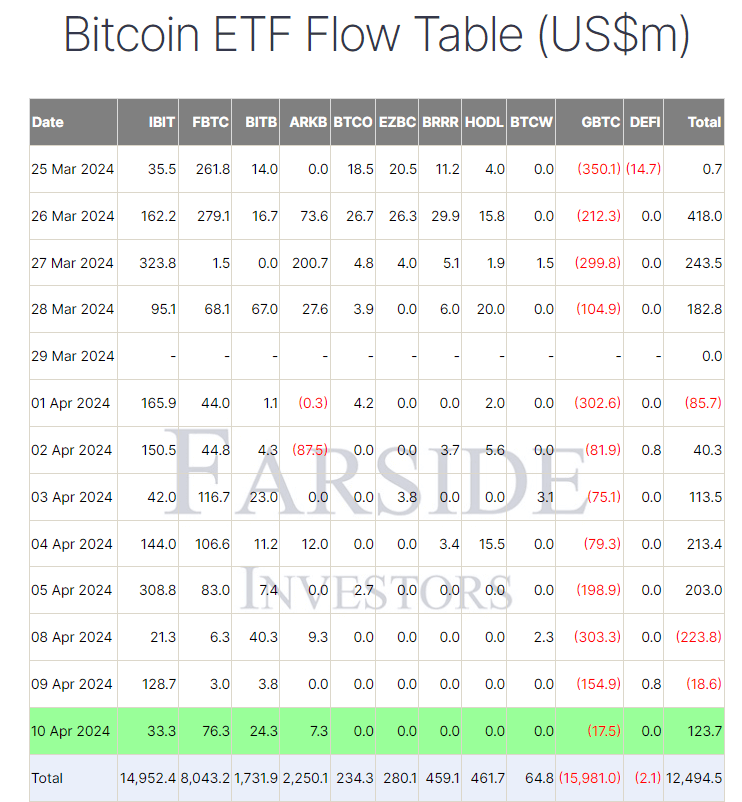

On April 10, GBTC skilled outflows of $17.5 million, a stark distinction to the $154.9 million recorded on April 9, based mostly on Farside information.

Bitcoin’s value has risen 2.08% over the previous 24 hours and is now valued at $70,542, based on CoinMarketCap. This adopted a dip to an area low of $67,482 after the March US Shopper Value Index (CPI) report indicated a higher-than-expected enhance of three.5% year-on-year. This growth raised considerations that the US Federal Reserve may additional delay rate of interest cuts.

Crypto business observers have expressed optimism that the slowdown in GBTC outflows, which have totaled $16 billion for the reason that fund transitioned to a spot Bitcoin ETF in January, could also be starting.

Thomas Fahrer, CEO of crypto-focused evaluations portal Apollo, requested his 41,500 X followers on April 11 if “GBTC gross sales [is] about?” He famous that the outflow on April 10 was roughly equal to 250 Bitcoin, a drop of virtually 95% from the start of the week.

On April 8, simply days earlier than, Grayscale noticed an outflow of 4,288 Bitcoin, totaling $303 million.

The bottom earlier outflow occurred on February 26 at $22.4 million, whereas the four-month common day by day outflow was $257.8 million.|

Amongst BTC ETFs, together with BlackRock IBIT, Constancy FBTC, ARK’s ARKB and Bitwise BITB, solely these recorded optimistic inflows on April 10, based on information from Farside.

FBTC led with an influx of $76.3 million, the biggest since April 5, bringing whole inflows to $8,043.2 billion. Collective web inflows into Bitcoin ETFs now stand at $12,494.5 billion.

Bitcoin’s upcoming halving, anticipated round April 20, is one other focal point for the market. The occasion will halve the issuance charge of Bitcoin blocks from 6.25 cash per block to three.125.

Halvings, which happen each 4 years, have traditionally led to an increase in Bitcoin’s value as a consequence of decreased provide development.

With the present enthusiasm round spot Bitcoin ETFs, the market expects even better demand, doubtlessly amplifying the rally.

In a Bloomberg interview on April 9, Fred Thiel, CEO of Bitcoin mining firm Marathon Digital, instructed that current spot Bitcoin ETF approvals have injected substantial capital into the market, accelerating the market’s appreciation, which was usually anticipated after the halving of Bitcoin.

Bitcoin’s value rose greater than 60% within the months main as much as the halving, with consultants pointing to a continued bullish market pushed primarily by rising demand reasonably than the availability drop from the halving.

“The previous halvings have brought on a notable provide shock, however this 12 months can be completely different. It is because we’ve by no means had a provide shock and a requirement shock on the identical time. And the catalyst is undoubtedly ETFs – single-day inflows into spot BTC ETFs have already crossed the $1 billion mark,” Andras Kristof, CEO and co-founder of Galaxis, instructed Crypto.information.

He additional instructed that if demand for the brand new ETFs is as excessive as it’s now, it can solely enhance day by day shopping for strain. In opposition to the backdrop of declining provide, this might end in a major spike in bitcoin’s value and volatility.

“Though the value of Bitcoin has greater than doubled up to now 12 months, there’s nonetheless steam within the rally. The halving impact will probably appeal to institutional traders from the sidelines as they succumb to the worry of lacking out.”