share this text

![]()

![]()

Bitcoin plummeted this weekend after a drone assault by Iran on Israel. Fueled by tensions within the Center East and the upcoming halving, the worth fell from $68,000 to round $60,000 on Saturday, liquidating $1.2 billion in lengthy positions. Regardless of this sharp correction, Michael Saylor, co-founder of MicroStrategy, expressed a optimistic outlook, saying, “Chaos is nice for Bitcoin.”

Chaos is nice for #Bitcoin.

— Michael Saylor⚡️ (@saylor) April 13, 2024

His assertion was shared on But the corporate has a major revenue of over $6 billion.

Saylor’s feedback sparked combined reactions throughout the crypto group. Some criticized his timing because of the ongoing worldwide battle, whereas others agreed together with his view of Bitcoin as a “hedge in opposition to chaos.”

Historic knowledge exhibits that Bitcoin typically experiences preliminary value declines throughout geopolitical instability, however tends to get better as it’s seen as a long-term haven.

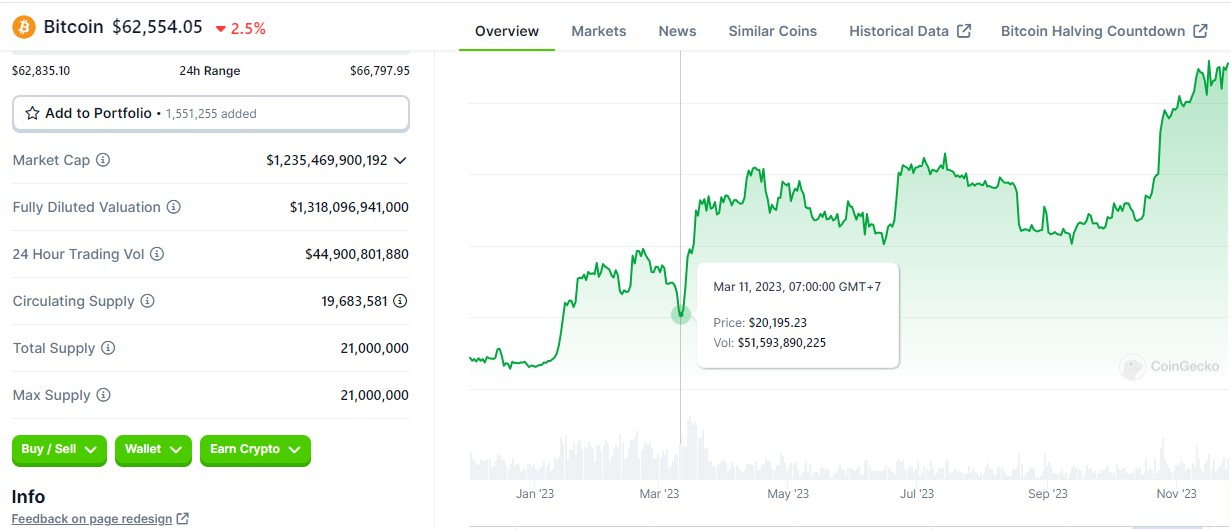

For instance, after the battle between Russia and Ukraine started in February 2022, Bitcoin’s value fell to round $39,000 however recovered to $44,000 inside every week, in line with knowledge from CoinGecko. Equally, after the Israel-Hamas battle in October 2023, Bitcoin initially fell 6%, however rose to $35,000 inside a month.

The banking issues final March additionally replicate this sample, though Saylor’s remark was not essentially associated to financial chaos.

When Silicon Valley Financial institution suffered financial institution runs on March 10, 2023, Bitcoin’s value briefly fell under $20,500, however rapidly recovered and rose to a nine-month excessive in late March. This restoration was additional strengthened by BlackRock’s utility for a spot Bitcoin ETF.

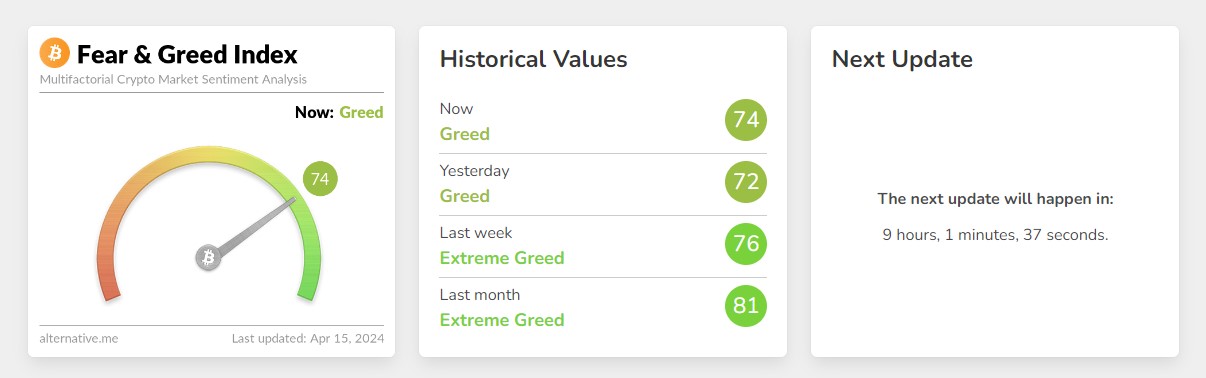

Regardless of the latest battle fears, Bitcoin market sentiment stays bullish. In line with Different’s knowledge, the Concern and Greed Index at the moment stands at 74, indicating “greed” – down from “excessive greed” however nonetheless reflecting sturdy investor confidence. This optimism is probably going fueled by the upcoming halving, which has traditionally been adopted by a Bitcoin value spike a number of months later.

Bitcoin clawed again $66,000 earlier immediately after Hong Kong formally accepted spot Bitcoin and Ethereum ETFs. On the time of writing, Bitcoin is buying and selling at round $62,500, down 2.5% up to now 24 hours, in line with CoinGecko knowledge.

share this text

![]()

![]()