On-chain information exhibits that Solana and different prime cryptocurrencies have seen a decline in buying and selling quantity not too long ago. This says this concerning the market.

Buying and selling volumes of Solana, Bitcoin and Ethereum have fallen over the previous month

That is evident from information from the on-chain evaluation firm HolyBuying and selling quantity within the cryptocurrency market has declined since peaking in early March.

The ‘buying and selling quantity’ right here refers back to the whole quantity of a selected asset concerned in trades on the assorted spot cryptocurrency exchanges.

When the worth of this metric is excessive, it signifies that a whole lot of cash are being moved on these platforms, indicating that buying and selling curiosity within the asset in query is excessive in the meanwhile.

Alternatively, low indicator values might indicate that the cryptocurrency market is presently inactive. Such a development could possibly be an indication that normal curiosity within the coin is presently low.

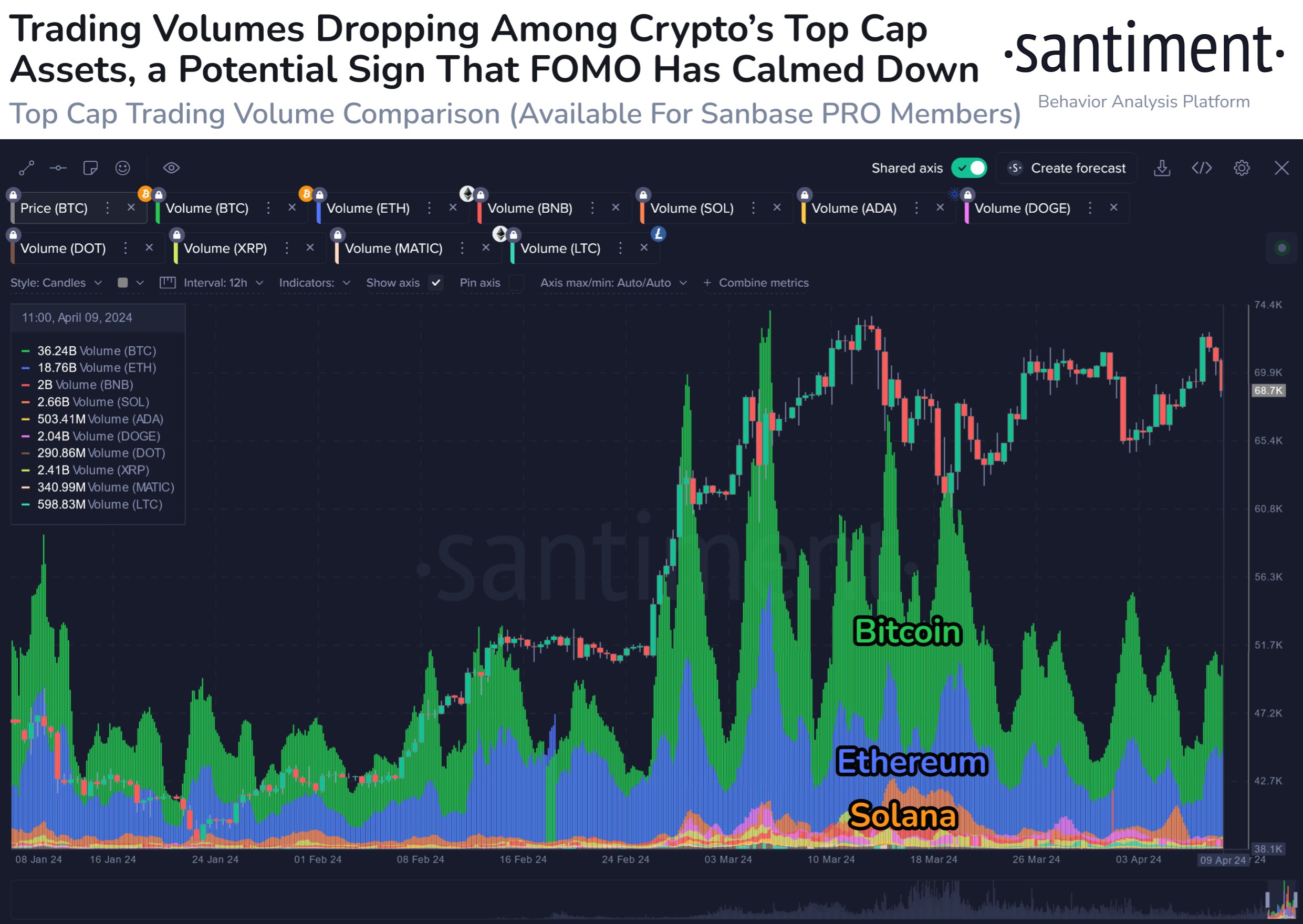

Here’s a chart exhibiting the development in buying and selling quantity for a number of prime belongings within the sector, similar to Bitcoin (BTC), Ethereum (ETH), and Solana (SOL):

Appears to be like like the worth of the metric has gone down for all of those cash not too long ago | Supply: Santiment on X

As proven within the chart above, buying and selling quantity of those prime cryptocurrencies skyrocketed in late February and continued to see such values into the early days of March.

The indicator recorded a very pronounced peak on March 6. Since this peak, nevertheless, the metric has remained in a gradual state of decline.

“This seems to be partly because of the various sample that started in mid-March, which created much less confidence in merchants making the best determination,” the analytics agency explains.

Bitcoin has clearly taken the biggest share of buying and selling quantity of any asset, whereas Ethereum, the second largest coin, has seen the second largest share.

Apparently, amongst altcoins, Solana has usually tended to stay primary, even supposing BNB (BNB) has a bigger market capitalization. For SOL, the quantity spike got here just a little later than for BTC and ETH, maybe reflecting the truth that the coin continued to development upward whereas many others collapsed in mid-March.

Finally, nevertheless, quantity for Solana declined, in step with the development adopted by the opposite prime belongings. So evidently curiosity available in the market as an entire has been waning currently.

“As soon as Bitcoin, Ethereum and different prime caps begin to transfer in a constant route once more, you may count on constant transactions to start out rising once more,” Santiment says.

SOL Award

The previous week has not been the very best of occasions for Solana traders, because the asset’s worth has fallen by greater than 12% inside this era, bringing the value to simply $165.

The worth of the asset seems to have plummeted over the previous few days | Supply: SOLUSD on TradingView

Featured picture from Shutterstock.com, Santiment.internet, chart from TradingView.com