Solana’s value efficiency has been outstanding in latest instances, surpassing Ripple and Binance Coin to turn into the fourth largest cryptocurrency by market capitalization. The SOL value crossed the vital $100 stage this weekend for the primary time since April 2022, boosting optimism amongst buyers. Nevertheless, the altcoin has corrected by 7%, indicating that the market is overheated. On the time of writing, the ‘Ethereum killer’ was buying and selling barely decrease at $111.60.

SOL Outlook

The Solana value has made a major restoration in latest weeks and has risen above the psychological stage of $100. The altcoin has been one of many best-performing belongings this 12 months, extending its year-to-date positive aspects to over 1,025%, posting extra positive aspects prior to now month alone. However even with such progress, analysts have famous that Solana has a dismal likelihood of surpassing its $260 ATH.

The rationale behind that is the rise in provide in relation to its worth. In November 2021, when the Solana value reached an all-time excessive of $260, the whole market capitalization was roughly $78 billion. Regardless of the crypto asset’s worth being lower than half of what it was on the prime, its market capitalization at the moment hovers round $50 billion.

This was brought on by the rise in Solana provide by greater than 100 million SOL prior to now two years. In response to some analysts, to retest the $260 mark, the altcoin’s whole market cap would have to be round $111 billion, which appears fairly tough as institutional buyers pour billions into the belongings.

The latest enhance in SOL is because of substantial actions within the chain. The continued hype for the blockchain’s quick transactions and low cost charges has boosted SOL’s on-chain exercise. Moreover, the crypto market has been within the inexperienced in latest weeks, boosted by a weaker US greenback and the potential deadline for the primary approval of a spot Bitcoin ETF on January 10, 2024.

Solana Worth Outlook

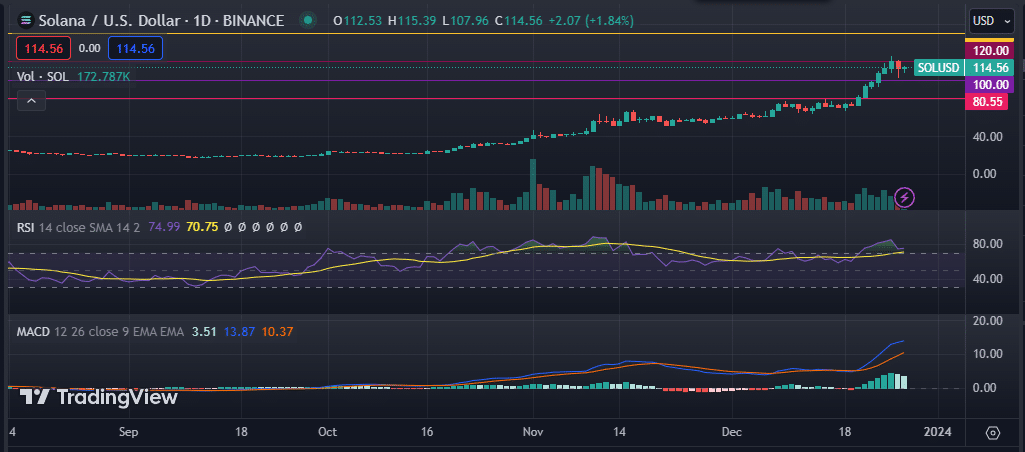

Solana value has been on a robust bullish trajectory in latest weeks regardless of a robust rejection on the key USD 120 resistance stage. The digital asset stays above the 50- and 200-day exponential shifting averages and the 100- and 200-day easy shifting averages. The Relative Energy Index (RSI) is at 74, indicating the asset is overbought because of the latest rally.

As such, the market must calm down for the rally to renew. Moreover, bullish momentum is at the moment waning, marked by the receding inexperienced bars of the Transferring Common Convergence Divergence (MACD) indicator.

Due to this fact, Solana value might endure a correction in the direction of $100 or decrease till the market cools down, at which level the worth would collect the power to renew its rally. Then again, if the bulls proceed to tout the altcoin, Solana might reverse the rapid resistance at $120, including confidence to its present market place.

SOL value chart