The Terra neighborhood would not appear to be catching a break currently. This time, prosecutors in South Korea have summoned representatives and staff of Terraform Labs to analyze the collapse of TerraUSD (UST), the corporate’s now failed stablecoin.

Terra workers has already testified

In accordance with a report by an area newspaper, the Monetary Crime Joint Investigation workforce of the Seoul Southern District Prosecutor’s Workplace known as all Terraform Labs staff to acquire related details about the corporate’s sudden collapse.

The staff, who’ve labored for Terra since 2019, have reportedly already given testimony. An unmanned operative revealed that the majority throughout the workforce have been conscious of Terra’s flawed self-correcting mechanism and had warned Do Kwon of a potential collapse.

South Korean prosecutors are utilizing this data to analyze whether or not Kwon and different Terra executives have been conscious of the flawed mechanism and potential shortcomings that would result in allegations of fraud and worth manipulation, in response to the report. Authorities are additionally investigating whether or not native exchanges went by correct itemizing assessment processes earlier than including LUNA and UST to their platforms.

Do Kwon Swimming in heat water

South Korean authorities are specializing in Terra’s token mechanism as a result of UST was not backed by fiat or some other collateral to guard customers in case of mass liquidations. Whereas Terra noticed speedy success in 2021 and early 2022, there have been a number of warnings a few potential UST depeg if the protocol ever got here below important promoting stress. And that is what occurred; on Might 7, UST started decoupling after promoting off whales and UST swaps for different stablecoins.

“In some unspecified time in the future it has no alternative however to break down as a result of it can’t deal with the curiosity funds and fluctuations in worth.” Authorities reportedly stated so.

The truth is, in response to a leaked doc from the Supreme Court docket’s registration workplace, Do Kwon is alleged to have dissolved two places of work in South Korea. There have been rumors that Kwon was making an attempt to keep away from taxes, however that shortly backfired when the nation’s nationwide tax authorities fined Terraform Labs and its executives $78 million for tax evasion.

Terra’s impending collapse brought about a massacre that unfold all through the crypto market. In accordance with reviews, the breakup of UST and LUNA has affected greater than 300,000 buyers in South Korea, with a few of them submitting lawsuits in opposition to Terraform Labs and Do Kwon. One of many affected buyers was arrested after he tried to knock on Kwon’s door. Just a few days after the assault, Kwon was known as to testify earlier than South Korean authorities at a parliamentary listening to in regards to the firm’s sudden collapse.

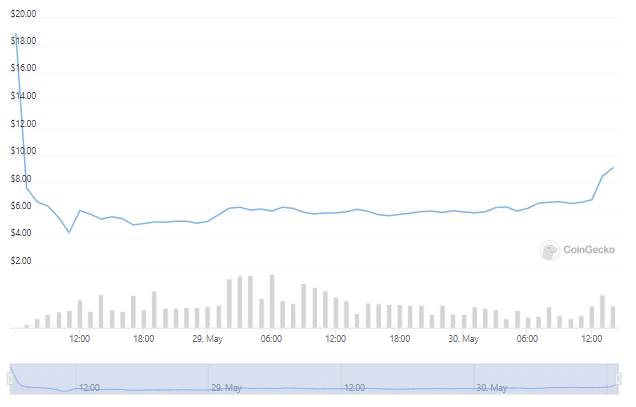

LUNA 2.0 is launched: drops 70% in a single buying and selling day

The information comes three days later Coin central reported the relaunch of the Terra blockchain and its new token, LUNA 2.0. —which was despatched to affected LUNA Traditional (LUNC) holders. Nonetheless, the brand new LUNA token was pumped by 30% after which dumped by 70% on the most important exchanges within the first hours of buying and selling. A number of buyers took to Twitter to say they have been promoting their LUNA as quickly because it was prepared for buying and selling in an try to get well a small portion of their misplaced capital from the earlier undertaking.

Individuals needed to promote to make up for some losses. Many individuals fell behind on their payments because of the collapse of Luna and they also needed to make the most of the launch of Luna 2.0 and seize some cash in case Terra 2.0 fails. Investor confidence in Luna is low. No person needs to lose twice.

— Tajo Crypto (@TajoCrypto) May 28, 2022

Regardless of the turmoil, a handful of high-profile cryptocurrency exchanges, together with FTX and Binance, presently help LUNA buying and selling, and several other decentralized protocols have helped Terra rebuild its ecosystem. Polygon, probably the most well-liked Ethereum sidechains, introduced the launch of an “uncapped multi-million greenback fund” to assist migrate tasks on the outdated Terra platform to the brand new blockchain.

Crypto customers on Twitter have expressed their insecurity in Terraform Labs, whereas a few of them hope that the brand new Terra blockchain will rise from the ashes and regain some traction out there. On the time of writing, LUNA is buying and selling at $9.12, recouping a gradual 50% of its losses, in response to CoinGecko information.