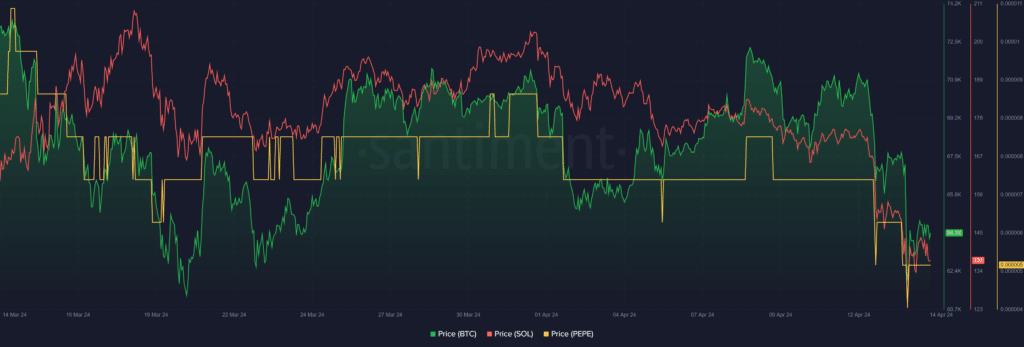

Bitcoin (BTC) and Solana (SOL) had been two of the highest property hit by final week’s crypto market downturn. In the meantime, Pepe (PEPE) skilled a sharper worth drop.

This worth crash reverberated throughout the cryptocurrency market, with the worldwide crypto market capitalization shedding greater than $280 billion over the previous seven days in a large 10% drop to $2.32 trillion on the time of writing.

Here is a have a look at how a number of the most affected cryptocurrencies carried out over the previous week:

BTC drops to one-month low

Apparently, Bitcoin began the week on a good notice, seeking to construct on the momentum it registered final week from April 3 to 7. The highest crypto asset retook the $70,000 threshold for the primary time in additional than per week on April 8, surpassing the $72,000 mark and ending the day with a formidable 3.25% acquire.

Nevertheless, the subsequent day the bears took management of the scene, pushing BTC under the $70,000 mark and inflicting a 3.45% loss, successfully wiping out Monday’s positive aspects. Hotter than anticipated US inflation knowledge exacerbated the downward spiral. Bitcoin staged a comeback because it fell to the $68,318 assist on the 21-day EMA.

A resurgence in power noticed Bitcoin get well the $71,000 zone, however the resistance that adopted capped an extra rally. The remainder of the week was marred by a continued worth decline as tensions surrounding the looming battle between Iran and Israel added to the bearish stress.

Bitcoin noticed three consecutive days of declines from April 11 to 13, culminating in a surprising crash to a one-month low of $61,596 on April 13. Regardless of recovering from this backside, BTC stays in a downtrend, down 8% up to now two days. because it struggles to regain and maintain the $65,000 space.

SOL breaks under the 50-day EMA

Solana’s begin to the week was not as vital as Bitcoin’s, however the subsequent worth drop was a lot steeper. Regardless of seeing solely a modest 0.67% acquire on April 8 as BTC led the market to a short-term restoration, SOL crashed 4.63% the subsequent day as BTC sparked a downtrend.

Equally, the April 10 restoration noticed solely a 0.56% improve, with the remainder of the week introducing one of many largest worth drops for Solana this yr. From April 11 to 13, Solana posted a discouraging 21.19% decline, abandoning the Fibonacci assist ranges of 0.618 ($171.09), 0.5 ($161.11), and 0.382 (151.14).

Extra importantly, Solana’s three-day downward spiral resulted in a collapse under the essential 50-day EMA, which stood at $162.30 on April 12. The SOL closed under this stage for 2 consecutive days. The final time the asset witnessed this occasion was in September 2023.

Solana additionally waived psychological assist of $150 and $140, buying and selling at $139.94 on the time of reporting. The cryptocurrency is down 24% this week after shedding $19 billion in market capitalization since April 8.

PEPE CCI falls to a nine-month low

Pepe couldn’t escape the carnage seen within the wider market this week.

The frog-themed meme coin finally fell to a one-month low under the $0.000004 assist. The positive aspects at the beginning of the week exceeded these of Bitcoin, however so did the losses – proof of the elevated volatility within the meme coin market.

The meme coin rose 4.30% on April 8, reaching a excessive of $0.00000796 earlier than finally falling 9.28%, giving up not solely Monday’s positive aspects but additionally many of the worth he picked up final week.

After two days of delicate restoration, Pepe noticed a considerable drop of 19% on an intraday foundation on April 12. This collapse marked the most important intraday drop in nearly a yr (the final time Pepe noticed such a worth crash was when the value fell 30.47% on April 12). Might 8, 2023, shortly after launch).

After the 19% collapse on April 12, Pepe fell one other 14.86% the subsequent day.

Regardless of a light worth improve at the moment, Pepe continues to be buying and selling under $0.000006 and altering fingers at $0.00000525. The meme coin has fallen 29% this week, with the commodity channel index (CCI) crashing to -245, its lowest studying in 9 months.

Such a dramatically low CCI suggests Pepe is basically undervalued, with loads of room for progress. The final time the asset’s CCI reached this stage, it witnessed three extra months of constant declines, falling to a low of $0.00000061 on October 19, 2023, earlier than finally recovering.