PayPal’s entry into the stablecoin market on August 7, 2023 was welcomed by many within the trade, with Circle CEO Jeremy Allaire stating that PayPal’s competitors was “nice to have.”

Information of the launch led to a modest 4% enhance in Bitcoin’s value, and inside days, exchanges had been providing low-cost promotional alternatives to merchants prepared to make use of PayPal’s PYUSD. Earlier than late August, Coinbase, Kraken, and HTX had listed the stablecoin and added Venmo help only a month later.

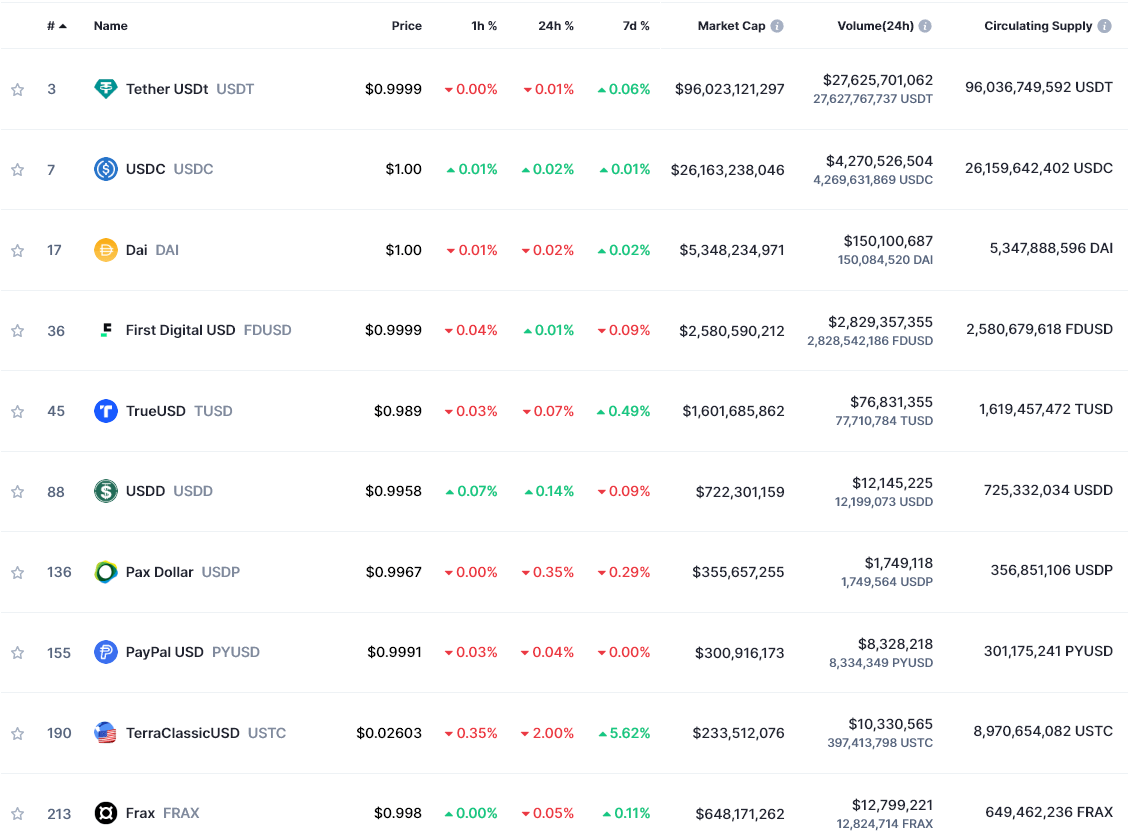

5 months after its launch, PYUSD has now claimed the eighth place within the international stablecoin charts by market capitalization, after reaching the $300 million mark round January 22. Nonetheless, PYUSD drops to eleventh place total, ranked by quantity, with simply $10 million. in 24-hour buying and selling quantity. This provides it solely a slight edge over UST Traditional, which, at a value of 98% off its initially focused $1 pin, traded simply $500,000 much less previously day.

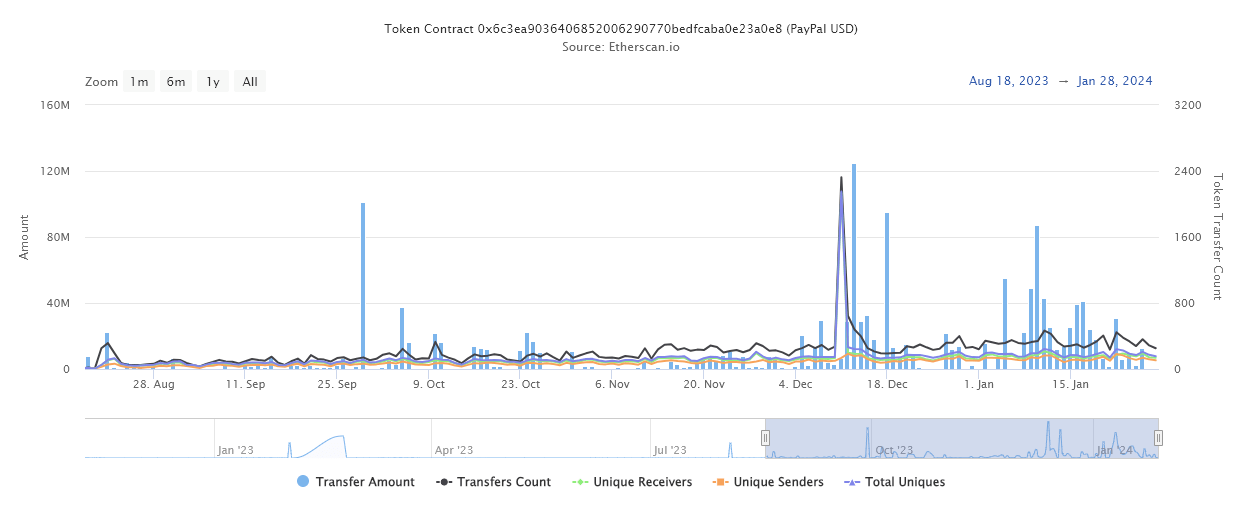

Nonetheless, PayPal’s PYUSD enhance to $300 million in worth in 5 months is spectacular. Along with a rise in market capitalization, the token has seen regular on-chain exercise, with a modest 200 – 400 transactions per day.

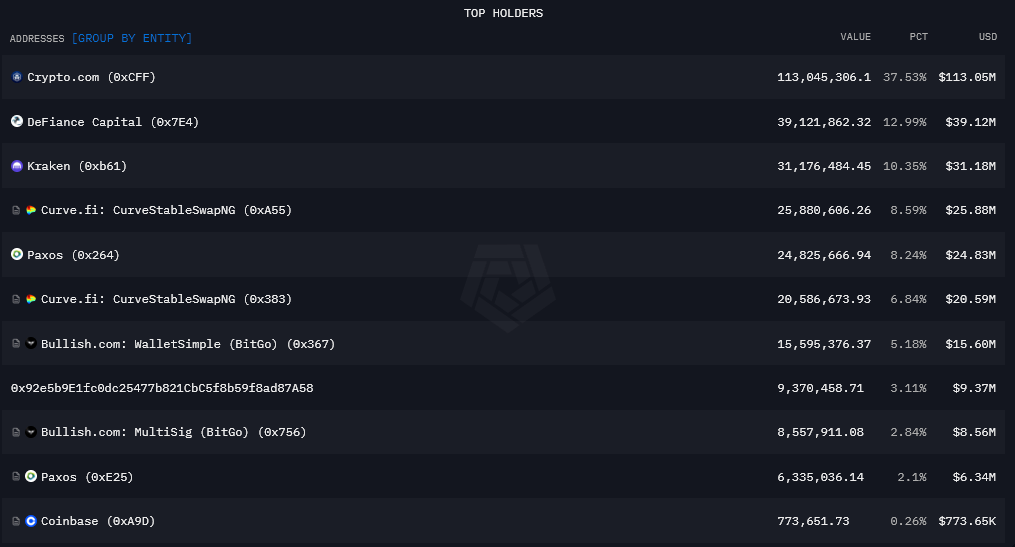

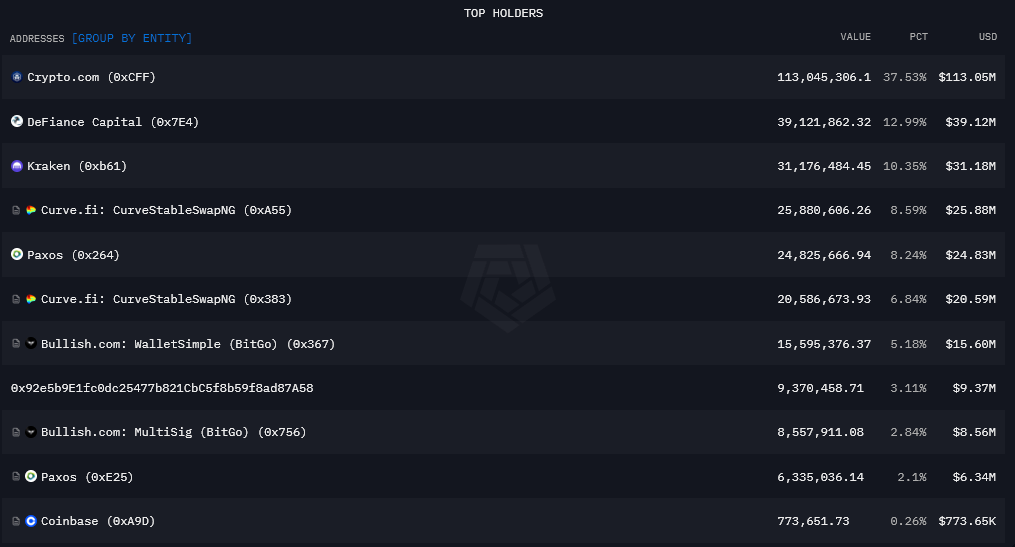

Nonetheless, PYUSD has but to penetrate the DeFi panorama in a significant manner, because the desk and chart under spotlight. The vast majority of PYUSD liquidity sits on centralized exchanges, with Crypto.com being the biggest holder of the token with $113 million, simply over a 3rd of the overall market capitalization.

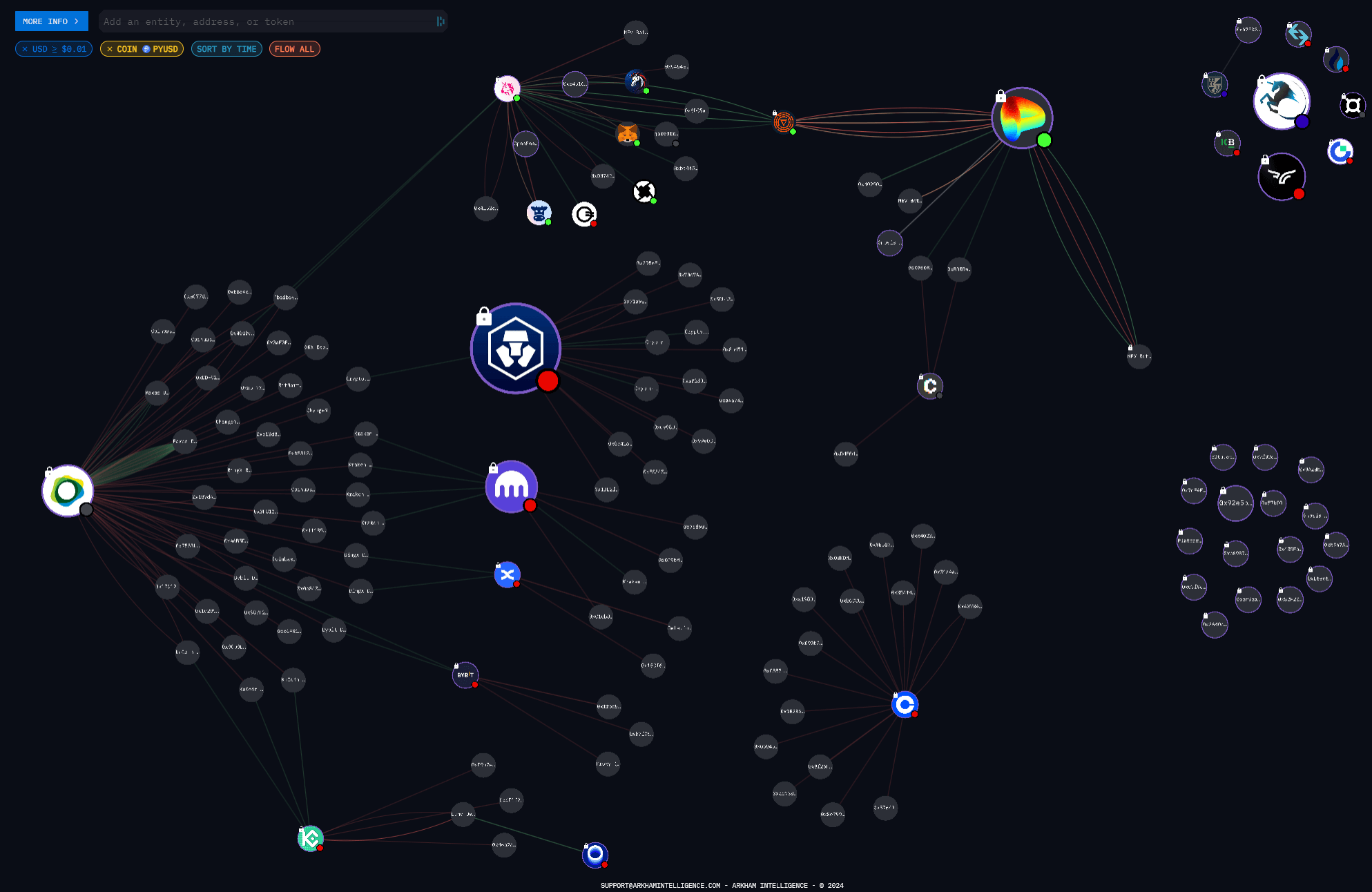

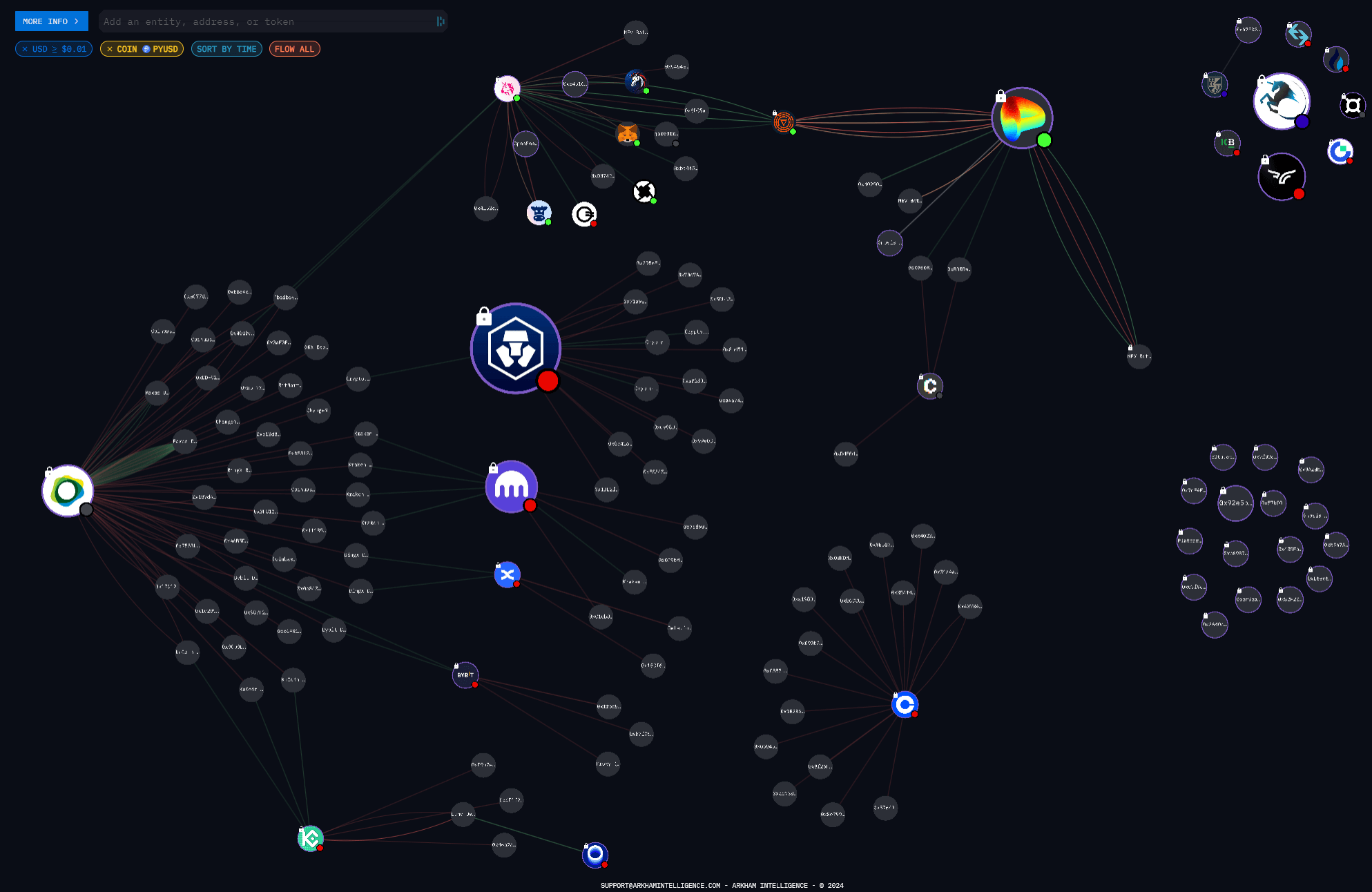

The visualization under reveals the transactions between main entities unique to PYUSD. Entities with extra substantial PYUSD holdings are proven bigger than entities with smaller quantities. The entities with out logos on the far proper are unknown wallets value over $30,000. The logos on the high proper present tokens of company entities, possible treasury holdings.

Apparently sufficient, there are a number of connections between PYUSD issuer Paxos, Uniswap, and Curve. But these entities are then disconnected from the main exchanges, indicating that the DeFi and CEX ecosystems for PYUSD are fully separate.

Though PayPal was subpoenaed by the SEC when PYUSD was half its present market cap, PayPal allegedly complied with the requests, and little has been heard on the matter since. The submitting announcement additionally marked the native low for PayPal’s share value, up 24% since November.

Moreover, PayPal Ventures lately started utilizing the PYUSD stablecoin as a mechanism for strategic investments, utilizing it for a stake within the institutional crypto platform Mesh. Amman Bhasin, Accomplice at PayPal Ventures, commented:

“Because the world of economic providers undergoes speedy transformation, we imagine consumer possession and asset portability will develop into a crucial constructing block for product innovation, with crypto serving as the primary bridgehead the place that is attainable.”

Though PYUSD nonetheless has an extended solution to go to catch giants like Circle and Tether, the debutant and web2 disruptor is actually strengthening its place within the sector.