Throughout the subsequent decade, block rewards will solely yield a small quantity of Bitcoin. What does this imply for miners and the individuals who rely on this blockchain?

Bitcoin halvings are as uncommon as World Cups and the Olympics. Why? As a result of they solely occur as soon as each 4 years.

In a world the place it’s tough to foretell the place the value of BTC will likely be from in the future to the following, halvings present some certainty as to when new cash will hit the market.

And contemplating that 93% of Bitcoin’s provide has already entered circulation, there’s another factor we all know: they’ll develop into more and more tough to seek out.

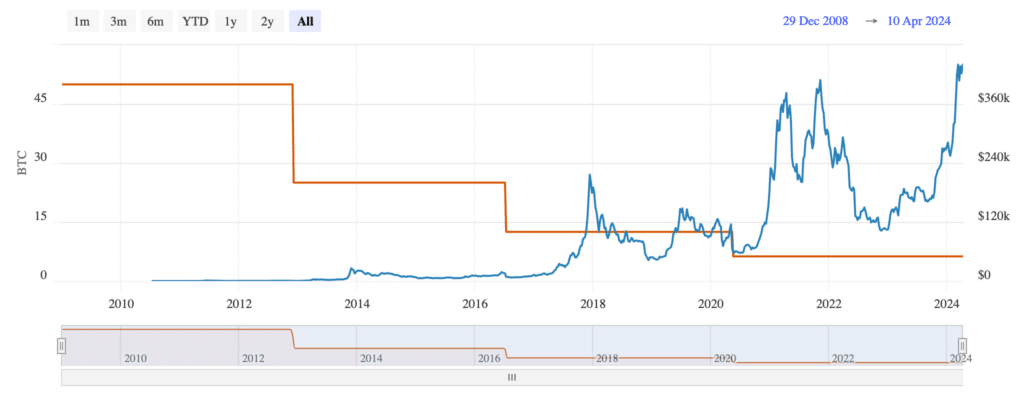

When the blockchain first launched in 2009, an enormous block reward of fifty BTC was supplied to miners. This dropped to 25 BTC in November 2012, with an additional 50% drop to 12.5 BTC in July 2016. On the third halving in Might 2020, rewards dropped to 12.5 BTC. single digits – 6.25 BTC each 10 minutes – and after this remaining reduce, solely 3.125 BTC is generated with every block.

As we all know, there may be good and unhealthy information for miners. On the one hand, the April 2024 halving means solely 450 Bitcoin will likely be up for grabs day-after-day, far lower than the 7,200 BTC obtainable every day 15 years in the past.

However on a extra optimistic be aware, the greenback worth of this cryptocurrency has gone by the roof. In fiat phrases, 3,125 BTC is value a whole bunch of hundreds of {dollars} at present market charges. On the time of the primary halving in 2012, 50 BTC would have solely gotten you $600.

What’s going to future halvings appear like? Let’s discover out.

When are future Bitcoin halvings?

The precise date is a bit onerous to foretell, however we actually have a tough determine. Halvings happen each 210,000 blocks – and with a brand new one being created each 10 minutes, the fifth discount in miner rewards is predicted in 2028… falling to 1.5625 BTC. This provide shock will take impact when the Bitcoin community reaches a block peak of 1,050,000.

Now let’s quick ahead to the 2030s, when Cathie Wooden predicts {that a} single Bitcoin will likely be value $1.5 million – and as a lot as $258,000 in her most bearish state of affairs. The 2032 halving will likely be vital, as it will likely be the primary time that block rewards will completely fall beneath one entire coin, to 0.78125 BTC. Satoshis, equal to at least one 100 millionth of a Bitcoin, will develop into more and more vital to miners.

Rewards will solely get smaller and smaller. By the point we attain the 12 months 2036, miners will obtain simply 0.390625 BTC for his or her function in holding the community protected. To place this into context, meaning solely 56.25 BTC is launched each 24 hours.

Halvings will happen each 4 years thereafter – every time coinciding with when the Summer time Olympics are held – in 2040, 2044, 2048 and past. Any passing occasion will change the reward miners obtain right into a rounding error. By 2052, they are going to solely obtain 0.0244140625 BTC as a thanks for including a block to the blockchain. On the time of writing, that will be value simply $1,660 in fiat phrases. The method will finish in 2140, when the availability of Bitcoin is lastly exhausted.

What does this imply for miners?

Being a Bitcoin miner is pricey. It takes a variety of electrical energy and large computing energy to win block rewards, and meaning {hardware} must be always up to date. BTC worth will increase have been in a position to offset the affect of every halving to this point, as you may see right here:

| Half-life date | New block reward | Value on the time of halving | |

| November 2012 | 25 BTC | $12.53 | |

| July 2016 | 12.5 BTC | $650.96 | |

| Might 2020 | 6.25 BTC | $8,601.80 |

With much less crypto obtainable, miners should maintain prices to a minimal to allow them to stay financially viable.

As time goes by, the transaction charges paid by blockchain customers will develop into an more and more vital income. This does not essentially imply that on a regular basis funds will develop into shockingly costly for customers – Layer 2s just like the Lightning Community and different futuristic options will maintain that – however the price of giant transfers might need to rise to maintain miners in enterprise.

In a latest report, Galaxy predicted that mergers and acquisitions will develop into more and more widespread to attenuate power prices, enhance effectivity, increase capital and obtain progress. We have now already seen smaller operators beginning to be part of forces. However whereas consolidation will likely be a needed evil, it could come on the expense of decentralization.

The 2024 halving is completely different in some ways. Not solely does it come on the heels of the launch of Bitcoin ETFs within the US, sparking a wave of latest investor curiosity, however this 12 months additionally marks the primary time BTC’s worth has hit a brand new all-time excessive earlier than block rewards have been reduce. Because the market adjustments, miners may even need to adapt.